Table of Contents

Introduction: Geopolitics in Global Economy – Why Global Power Moves Through Markets

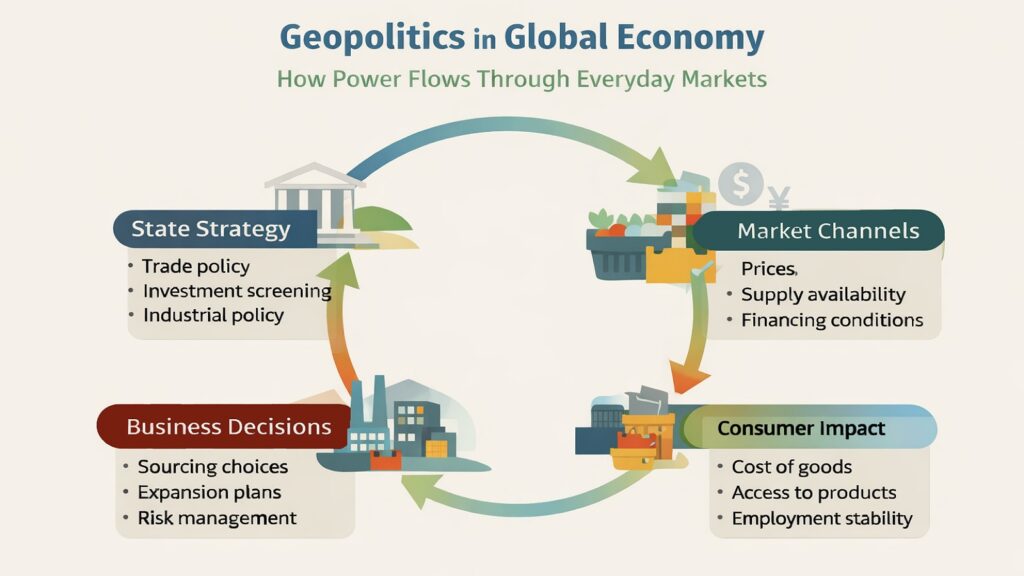

When oil prices spike or semiconductor shortages halt car production, most people see market forces at work. What they miss is the strategic hand behind the curtain. Geopolitics in Global Economy has evolved beyond tanks and treaties into something far more subtle and pervasive. Nations now compete through trade restrictions, supply chain dominance, and financial networks rather than military campaigns. The battlefield has shifted from borders to balance sheets.

Every supply chain disruption carries geopolitical fingerprints. Every currency fluctuation reflects power relationships. The global economy no longer operates as a neutral arena where market efficiency reigns supreme. Instead, it functions as contested terrain where nations advance strategic interests through economic design. A tariff becomes a warning. An investment ban signals alliance boundaries. Export controls reshape technological hierarchies without firing a shot.

Understanding Geopolitics in Global Economy matters because these strategic moves affect everyone. They determine which products reach which markets, where factories locate, and which currencies hold value. Businesses navigate investment restrictions. Workers face shifting employment landscapes. Consumers pay prices shaped by distant political calculations. The integration of geopolitics into economic structures means that purely economic analysis misses half the story.

This article unpacks six strategic economic moves that nations deploy to advance power without warfare. Trade policies function as diplomatic leverage. Supply chains become geopolitical assets. Financial systems operate as influence infrastructure. Sanctions calibrate behavior across borders. Technology standards lock in decades of advantage. Economic alliances replace ideological blocs. Together, these moves reveal how modern power flows through market mechanisms rather than military might.

Geopolitics in Global Economy: Building Blocks and Strategic Relationships

| Building Blocks of Global Economy | Geopolitical Relationship and Strategic Impact |

|---|---|

| Global Trade | Trade agreements and restrictions serve as diplomatic tools to reward allies and pressure adversaries, reshaping economic dependencies |

| Labor Migration | Workforce mobility policies influence innovation clusters and manufacturing competitiveness while managing demographic challenges |

| Global Tech Innovation | Technology leadership determines economic sovereignty as nations compete for semiconductor dominance and AI capabilities |

| Natural Resources and Energy | Control over critical minerals and energy sources translates directly into geopolitical leverage and economic security |

| Governance and Institutions | International institutions set trade rules and dispute mechanisms that reflect power balances among member nations |

| Global Supply Chain | Manufacturing networks and logistics routes become strategic assets that nations protect through reshoring and friendshoring |

| Global Financial Systems | Currency dominance and payment infrastructure enable sanctions enforcement while providing economic stability or isolation |

| Demographics | Population trends drive labor competitiveness and consumption markets that nations leverage for economic advantage |

| Climate and Sustainability | Green technology standards and carbon policies create competitive advantages while addressing shared environmental risks |

1. Geopolitics in Global Economy: Trade as a Strategic Weapon

Trade policy stopped being purely economic decades ago. Nations discovered that market access carries more weight than military threats in peacetime competition. Tariffs signal displeasure. Export bans demonstrate resolve. Preferential agreements cement alliances. What appears as trade friction often represents calculated strategic positioning rather than economic optimization.

When countries impose targeted restrictions, they pursue long-term reshaping of economic relationships rather than short-term revenue gains. These measures aim to increase dependency among allies while reducing it among rivals. Geopolitics in Global Economy operates through selective openness that rewards alignment and punishes divergence. The trading system fragments into competing spheres rather than converging toward integration.

Export controls on advanced technologies exemplify this strategic approach. Restricting semiconductor equipment or AI chips limits rival capabilities years into the future. The immediate economic cost matters less than the cumulative advantage gained. Similarly, agricultural trade can become leverage when food security concerns amplify political pressure. Markets that seem purely commercial often serve strategic purposes.

Trade agreements now function as alliance frameworks rather than efficiency mechanisms. Partners negotiate coordinated approaches to third parties alongside tariff reductions. Supply chain integration within agreement zones increases mutual dependence and raises exit costs. The economic ties bind political relationships through shared production networks and investment flows.

This weaponization of trade creates winners and losers beyond the direct participants. Third countries face pressure to choose sides as trading blocs demand compatibility with their standards and restrictions. Neutral positions become harder to maintain when market access requires alignment. The global trading system transforms from universal rules toward competing economic communities.

Geopolitics in Global Economy: Trade Mechanisms and Strategic Applications

| Trade Mechanism | Strategic Application and Impact |

|---|---|

| Export Controls | Semiconductor equipment restrictions limit technological advancement in rival nations while protecting innovation leadership |

| Tariff Escalation | Progressive duties on processed goods encourage raw material exports while discouraging value-added manufacturing competition |

| Preferential Agreements | Regional partnerships like RCEP and USMCA create integrated economic zones that align strategic interests |

| Import Licensing | Administrative barriers control market access without formal tariffs while maintaining plausible economic justifications |

| Agricultural Trade | Food export policies leverage supply security to influence political positions during diplomatic negotiations |

| Services Restrictions | Digital services and financial access limitations protect domestic industries while limiting foreign economic influence |

2. Geopolitics in Global Economy: Control of Supply Chains and Chokepoints

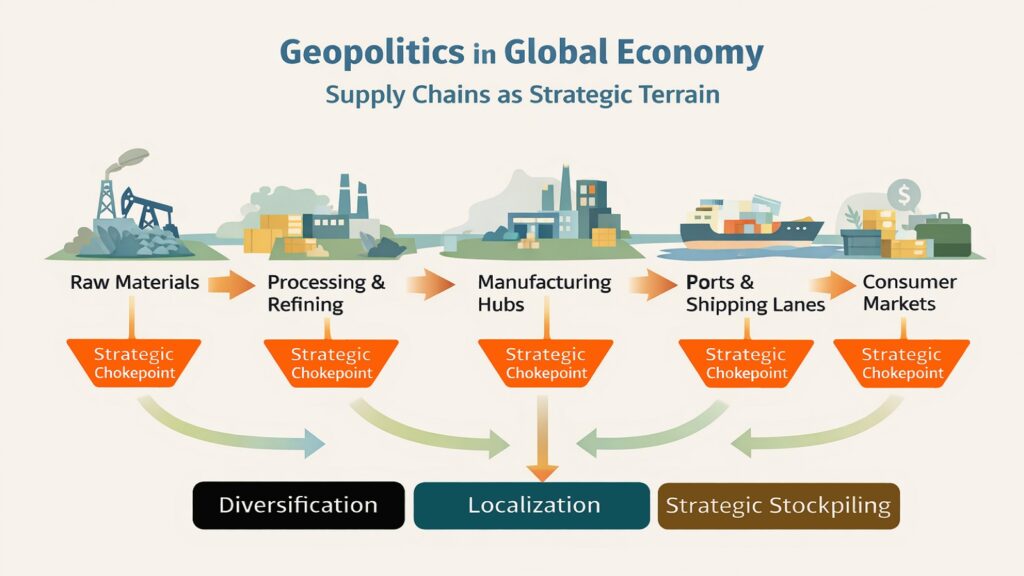

Supply chains reveal vulnerability as clearly as they enable prosperity. Nations recognize that dependence on foreign production creates strategic exposure. A port closure or export ban can halt entire industries overnight. This awareness transforms supply chain management from business optimization into national security planning.

Geopolitics in Global Economy operates most visibly through control of manufacturing hubs and transportation routes. Countries that dominate production of essential components gain leverage over downstream industries globally. Rare earth processing, pharmaceutical ingredients, and battery materials concentrate in specific locations not by pure market efficiency but through strategic industrial policy.

Shipping chokepoints like the Strait of Hormuz or Malacca Strait carry geopolitical weight because disruption affects global commerce disproportionately. Nations invest in naval capabilities and alternative routes to reduce dependence on passages others might control. The geography of trade creates natural leverage points that strategic actors seek to dominate or bypass.

Responses to supply chain vulnerability drive major economic shifts. Reshoring initiatives bring production home despite higher costs. Friendshoring concentrates supply networks among political allies. Diversification spreads risk across multiple sources. These adjustments reflect geopolitical calculation rather than pure efficiency seeking. The additional expense buys strategic autonomy.

The pandemic exposed how quickly supply disruptions cascade through interconnected systems. Semiconductor shortages idled automobile plants. Personal protective equipment scarcity revealed medical supply dependencies. These experiences accelerated efforts to secure critical supply chains through redundancy and domestic capacity. Economic efficiency yields to strategic resilience as the primary design principle.

Geopolitics in Global Economy: Critical Chokepoints and Strategic Responses

| Chokepoint or Vulnerability | Strategic Significance and Response |

|---|---|

| Rare Earth Processing | China processes over 90% of rare earths used in electronics, prompting Western nations to develop alternative processing capacity |

| Semiconductor Fabrication | Taiwan produces majority of advanced chips, driving US and EU investments in domestic foundries through CHIPS Act and EU legislation |

| Strait of Malacca | Over 25% of traded goods pass through this channel, motivating China’s Belt and Road alternative routes |

| Pharmaceutical Ingredients | India and China dominate generic drug components, spurring reshoring initiatives after COVID supply disruptions |

| Container Shipping | Port congestion and carrier consolidation create bottlenecks that nations address through infrastructure investment and domestic logistics |

| Battery Supply Chain | Lithium processing and battery cell production concentrate in East Asia, driving Western mining and manufacturing initiatives |

3. Geopolitics in Global Economy: Financial Systems as Power Infrastructure

Money flows reveal power relationships as surely as military deployments. The architecture of global finance determines who can transact with whom under what conditions. Currency dominance, payment networks, and debt markets function as influence infrastructure that shapes behavior across borders. Financial systems enable stability for allies while creating pressure points against adversaries.

The dollar’s role as global reserve currency provides enormous strategic advantage. International transactions predominantly settle in dollars regardless of the parties involved. This centrality allows monitoring of global financial flows and enforcement of restrictions through banking system access. Geopolitics in Global Economy operates through this financial plumbing that most participants take for granted until access disappears.

Payment systems like SWIFT became geopolitical tools when access could be denied to specific countries or entities. Disconnection from international payment networks isolates economies more effectively than traditional sanctions. The threat of financial exclusion influences behavior among nations that depend on global trade and investment flows.

Debt relationships create dependencies that extend beyond pure economics. Countries holding substantial foreign debt face policy constraints when creditors can influence their economic choices. Conversely, major creditor nations gain leverage over debtor countries through refinancing terms and conditions. Development lending becomes a tool for building influence in recipient nations.

Alternative financial systems emerge as responses to Western payment network dominance. Digital currencies and regional settlement mechanisms aim to reduce dollar dependence and create transaction channels outside existing monitoring. These efforts reflect strategic pursuit of financial autonomy rather than purely technical innovation. The fragmentation of financial infrastructure follows geopolitical fault lines.

Geopolitics in Global Economy: Financial Power Mechanisms and Applications

| Financial Mechanism | Strategic Function and Impact |

|---|---|

| Reserve Currency Status | Dollar dominance in 88% of foreign exchange transactions enables transaction monitoring and sanctions enforcement |

| SWIFT Network | Belgium-based messaging system processes cross-border payments globally, creating exclusion leverage when access is denied |

| Development Lending | Bilateral and multilateral loans build influence in recipient nations through infrastructure financing and policy conditionality |

| Sovereign Debt Holdings | Foreign ownership of government bonds creates mutual dependencies that constrain policy autonomy for debtor nations |

| Central Bank Digital Currencies | China’s digital yuan and other CBDCs aim to reduce dollar dependence while enabling domestic transaction oversight |

| Regional Payment Systems | CIPS in China and SPFS in Russia provide alternatives to SWIFT, reducing vulnerability to Western financial restrictions |

4. Geopolitics in Global Economy: Sanctions, Incentives, and Economic Pressure

Economic pressure calibrates international behavior without military engagement. Sanctions restrict market access, freeze assets, and limit financial transactions to signal disapproval and impose costs. The effectiveness depends less on immediate economic damage than on sustained pressure that changes strategic calculations over time.

Modern sanctions target specific sectors, entities, or individuals rather than entire economies. This precision aims to minimize humanitarian costs while maximizing political impact. Technology sanctions prevent access to advanced equipment. Financial sanctions block dollar transactions. Energy sanctions reduce revenue from resource exports. Each form addresses different vulnerability points.

Geopolitics in Global Economy operates through sanctions that affect far more than intended targets. Third parties face compliance costs and reduced business opportunities when navigating restriction frameworks. Banks conduct extensive due diligence. Companies restructure supply chains. Investors avoid entire markets due to perceived risk. The ripple effects extend pressure beyond direct sanctions targets.

Incentives function as the positive complement to sanctions. Market access rewards alignment. Investment flows toward compliant partners. Development assistance supports friendly governments. These carrots matter as much as sticks in shaping behavior. The combination of restrictions and opportunities creates channels for acceptable conduct.

Sanctions effectiveness varies widely based on target characteristics and alternative options. Well-connected economies with diversified trade relationships can circumvent restrictions more easily than isolated ones. The rise of alternative payment systems and non-Western trade networks reduces Western sanctions leverage over time. Economic pressure works best when the sanctioning coalition controls access to essential markets or technologies.

Geopolitics in Global Economy: Sanctions Frameworks and Economic Pressure

| Sanctions Type | Application and Broader Impact |

|---|---|

| Technology Restrictions | Export controls on semiconductors and AI equipment limit military and industrial capabilities while affecting global tech supply |

| Financial Sanctions | Asset freezes and transaction blocks isolate central banks and major institutions from dollar-based financial system |

| Energy Sanctions | Oil price caps and export restrictions reduce revenue while disrupting global energy markets and supply routes |

| Secondary Sanctions | Penalties on third parties for sanctions violations extend compliance requirements beyond direct target nations |

| Investment Bans | Portfolio restrictions and equity prohibitions prevent capital flows to specific sectors or state-owned enterprises |

| Development Incentives | Infrastructure financing and market access rewards align recipient nations with donor strategic objectives |

5. Geopolitics in Global Economy: Technology and Standards as Silent Leverage

Technology standards have shaped economic power for decades without obvious coercion. The specifications that enable interoperability determine which companies dominate markets and which nations capture value from innovation. Standards-setting bodies appear technical and neutral but their decisions carry enormous strategic weight.

Digital infrastructure creates network effects that entrench early advantages. Dominant platforms set protocols that others must follow to participate. Cloud computing standards, telecommunications equipment, and internet architecture decisions made today constrain options for years ahead. Geopolitics in Global Economy operates through these technical specifications that become difficult to displace once adopted widely.

Nations recognize that technology leadership translates into economic influence. Investment in research facilities, education systems, and innovation ecosystems aims to secure positions at the frontier. Patent portfolios and intellectual property protection enforce the advantages gained through innovation leadership. The race for technological dominance drives industrial policy across major economies.

Artificial intelligence and quantum computing represent current battlegrounds where standards remain fluid. Early establishment of technical approaches and ethical frameworks will shape global adoption patterns. Countries pushing their preferred standards into international bodies gain first-mover advantages that compound through network effects and switching costs.

Technology fragmentation follows geopolitical divides as countries develop incompatible systems. Separate telecommunications networks, payment platforms, and social media ecosystems reduce global integration. This balkanization raises costs and limits efficiency but provides strategic autonomy. Nations accept economic trade-offs to avoid dependence on rival technology infrastructure.

Geopolitics in Global Economy: Technology Standards and Strategic Control

| Technology Domain | Standards Impact and Strategic Competition |

|---|---|

| 5G Telecommunications | Equipment standards determine network architecture globally, with Western and Chinese systems developing incompatibly |

| AI Governance Frameworks | Regulatory approaches shape competitive advantages as EU, US, and China pursue different balances between innovation and control |

| Semiconductor Architecture | Chip design standards from ARM and x86 create ecosystems that lock in decades of software and hardware compatibility |

| Cloud Computing Protocols | Platform standards from major providers determine data sovereignty and interoperability across global operations |

| EV Charging Infrastructure | Competing standards for electric vehicle charging affect automotive market access and manufacturing locations |

| Cybersecurity Certification | Equipment security standards create market barriers that favor domestic producers while restricting foreign competition |

6. Geopolitics in Global Economy: Alliances Built on Economic Alignment

Modern alliances coalesce around economic compatibility as much as shared values. Investment flows concentrate among partners with aligned regulatory frameworks and compatible standards. Production networks integrate within alliance boundaries while fragmenting across geopolitical divides. Economic coordination amplifies individual capabilities through collective action.

Trade agreements increasingly include provisions on labor standards, environmental rules, and digital governance that extend beyond tariff reduction. These broader frameworks create economic communities with common approaches to regulation and competition. Membership signals alignment while exclusion marks strategic distance. Geopolitics in Global Economy shapes which nations can access integrated production networks and investment flows.

Security alliances now incorporate economic dimensions that reinforce military cooperation. Technology sharing agreements prevent capability gaps among partners. Supply chain coordination ensures access to critical materials during crises. Financial integration provides stability during turbulence. The layering of economic ties onto security relationships makes alliances more durable and multifaceted.

Regional economic blocs compete for members through market access and development assistance. Smaller nations navigate between competing offers, seeking maximum benefit while managing strategic risk. The choice of economic alignment carries long-term consequences as production networks and technology standards lock in relationships that become difficult to reverse.

Economic alignment reduces transaction costs and political risk for businesses operating within alliance frameworks. Shared standards enable seamless operations across borders. Coordinated policies reduce regulatory uncertainty. Mutual investment protections provide stability. These advantages create incentives for deepening integration within economic communities while raising barriers to cross-bloc engagement.

Geopolitics in Global Economy: Alliance Structures and Economic Integration

| Alliance Framework | Economic Integration and Strategic Function |

|---|---|

| Indo-Pacific Economic Framework | US-led initiative coordinates supply chains and digital trade standards among fourteen Pacific nations |

| Belt and Road Initiative | Chinese infrastructure investment across seventy nations builds trade routes and economic dependencies |

| EU Single Market | Deep regulatory integration creates unified economic space with coordinated external trade and competition policies |

| RCEP Trade Agreement | Asia-Pacific partnership covering thirty percent of global GDP establishes common trade rules among fifteen members |

| AUKUS Technology Partnership | Defense technology sharing among Australia, UK, and US extends to quantum computing and AI development |

| BRICS Cooperation | Some of the most important Global South Economies, such as Brazil, Russia, India, China, South Africa, coordinate on development banks and alternative payment mechanisms |

Conclusion: Geopolitics in Global Economy – The Future of Power Without War

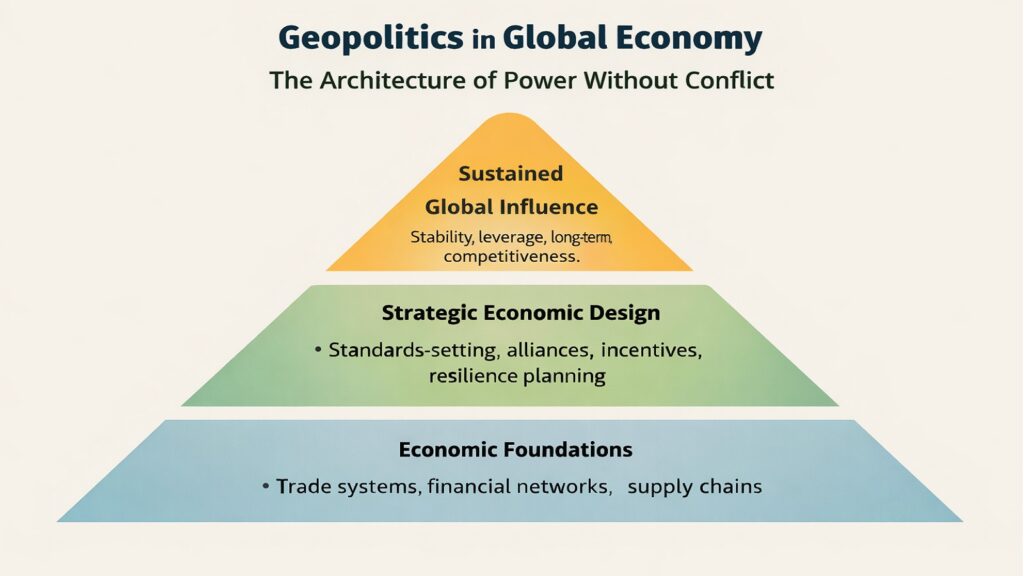

Power now flows through market mechanisms more than military force. The six strategic moves outlined here reveal a fundamental shift in how nations compete and cooperate. Trade policies reward alignment. Supply chain control creates dependencies. Financial systems enable or exclude. Sanctions calibrate behavior. Technology standards lock in advantages. Economic alliances amplify capabilities. Together, these moves constitute modern statecraft in an interconnected world.

Geopolitics in Global Economy affects everyone regardless of whether they follow international affairs. Consumers pay prices shaped by strategic competition. Workers face employment patterns driven by reshoring initiatives. Businesses navigate investment restrictions and supply chain requirements. The integration of geopolitics into economic structures means that purely market-based analysis misses the strategic calculations that drive major decisions.

The fragmentation of the global economy into competing spheres represents a defining trend. Universal rules give way to alliance-specific frameworks. Technology ecosystems develop along geopolitical lines. Financial networks are split between dollar-based and alternative systems. This balkanization reduces efficiency but reflects deeper strategic imperatives that override optimization concerns.

Understanding these dynamics becomes essential for navigating the emerging global order. Governments must balance economic openness with strategic autonomy. Companies need to assess geopolitical risk alongside market opportunities. Individuals face economic consequences from distant political decisions. The recognition that markets operate within geopolitical contexts rather than apart from them changes how we interpret economic events.

The future will likely see continued evolution of economic statecraft as nations refine their strategic toolkits. Digital currencies may reshape financial leverage. Climate policies could create new forms of economic pressure. Technology breakthroughs might shift competitive advantages. What remains constant is the fundamental insight that economic design serves strategic purposes. Power without war requires understanding how market mechanisms advance national interests in a world where interdependence creates both opportunity and vulnerability.

Geopolitics in the Global Economy: Strategic Implications and Future Trajectories

| Strategic Domain | Future Trajectory and Long-Term Impact |

|---|---|

| Economic Fragmentation | Continued bifurcation into competing economic spheres reduces global integration while increasing resilience within blocs |

| Technology Sovereignty | Nations pursue domestic capacity in critical technologies despite efficiency losses to secure strategic autonomy |

| Financial Architecture | Alternative payment systems and digital currencies gradually reduce dollar dominance while fragmenting global finance |

| Supply Chain Resilience | Redundancy and diversification replace just-in-time efficiency as companies prioritize security over cost optimization |

| Climate as Leverage | Green technology standards and carbon border adjustments create new competitive advantages and pressure points |

| Alliance Economics | Deepening integration within blocs contrasts with rising barriers between them as alignment determines market access |