Table of Contents

Introduction: Global Trade Security Risks Disrupting Regional Trade Alignment

Global Trade Security Risks now sit at the center of how nations choose their trading partners and design their commercial relationships. For decades, globalization operated on the premise that trade would follow efficiency, that borders would matter less, and that economic logic would override political concern. Those assumptions no longer hold. Countries now evaluate trading relationships through the lens of security first, asking whether a partnership exposes them to coercion or disruption before they consider cost savings or market access.

This shift marks more than a temporary adjustment to geopolitical tension. Global Trade Security Risks have fundamentally altered the calculus behind trade decisions. Where efficiency once dominated, resilience now competes for priority. Where distance and difference were tolerable, proximity and alignment have become valuable. Regional trade blocs are thickening not because countries reject global exchange, but because they perceive openness itself as a vulnerability when trust between major economies fractures.

The six forces examined here demonstrate how Global Trade Security Risks trigger fragmentation rather than simply reflect it. Each force shows a specific mechanism through which security concerns reshape trade architecture. Together, they reveal a pattern of structural change that will define world trade for the coming decades. Fragmentation is not collapse. It is a reorganization driven by the belief that security now outweighs the gains from unlimited openness.

Global Trade Security Risks and Their Impact on Building Blocks of The Global Economy

| Global Economy Building Blocks | How Global Trade Security Risks Disrupt It |

|---|---|

| Global Trade | Export controls and import restrictions segment markets and reduce trade volumes between rival blocs |

| Labor Migration | Visa restrictions limit movement of skilled workers in sensitive industries like semiconductors |

| Tech Innovation | Technology decoupling forces duplicate research infrastructure and slows knowledge diffusion |

| Natural Resources and Energy | Resource and energy nationalism drives countries to secure alternative sources at higher economic cost |

| Governance and Institutions | Multilateral bodies weaken as major powers create parallel institutions aligned with security interests |

| Global Supply Chain | Risk mitigation fragments production networks and pushes manufacturing closer to allied territories |

| Geopolitics | Security competition overrides economic integration as the organizing principle of international relations |

| Climate | Fragmented systems duplicate green technology development and complicate coordinated climate action |

| Global Financial Systems | Global Trade Security Risks fragment global financial systems by restricting cross-border payments, raising risk controls, and slowing the flow of trade finance across the global economy. |

1. Global Trade Security Risks Disrupting Trusted Trade Partnerships

Global Trade Security Risks force nations to reconsider not just what they trade but with whom. The composition of trading relationships now reflects political alignment and perceived reliability more than geographic logic or comparative advantage. Countries question whether commercial partners will remain stable suppliers during crises, whether they will use trade as leverage, and whether economic ties create unacceptable exposure to adversarial influence.

This reassessment weakens long-distance relationships built on efficiency alone. A manufacturer might source from the lowest-cost producer, but governments now intervene to redirect sourcing toward partners deemed trustworthy. The criteria for trust include political system compatibility, alignment on security issues, and a track record of honoring commitments under pressure. Neutral relationships face the greatest strain.

The result is clustering of trade along regional and ideological lines. The European Union deepens ties with member states while maintaining caution toward suppliers in rival spheres. The United States encourages nearshoring to Mexico and friend-shoring to allied democracies. China expands trade within its regional framework and with countries less concerned about Western security priorities. Each cluster becomes a distinct trading network.

This shift reduces the universality that characterized global trade in recent decades. The assumption that any country could trade with any other on purely commercial terms no longer applies in strategic sectors. Technology, critical minerals, pharmaceuticals, and advanced manufacturing now flow through trusted partnerships rather than open markets. Even in less sensitive sectors, the gravitational pull toward secure partners reshapes sourcing and investment flows.

Fragmentation emerges because trusted partnerships rarely align with the geographically dispersed networks that efficiency would dictate. Security-driven trade concentrates within regions or ideological groupings, leaving fewer links between them. Trade continues, but through narrower channels and with greater friction.

Global Trade Security Risks Reshaping Trade Partnership Criteria

| Traditional Trade Factor | Security-Driven Replacement |

|---|---|

| Lowest production cost | Reliable supply during geopolitical tension |

| Optimal logistics distance | Political alignment and shared values |

| Largest available market | Partners outside adversarial influence |

| Established suppliers | Diversification away from concentrated dependencies |

| Free trade agreements | Security partnership and intelligence sharing |

| Currency stability | Financial system alignment and sanctions coordination |

| Labor cost advantage | Domestic job protection and industrial base maintenance |

| Regulatory familiarity | Data sovereignty and technology transfer controls |

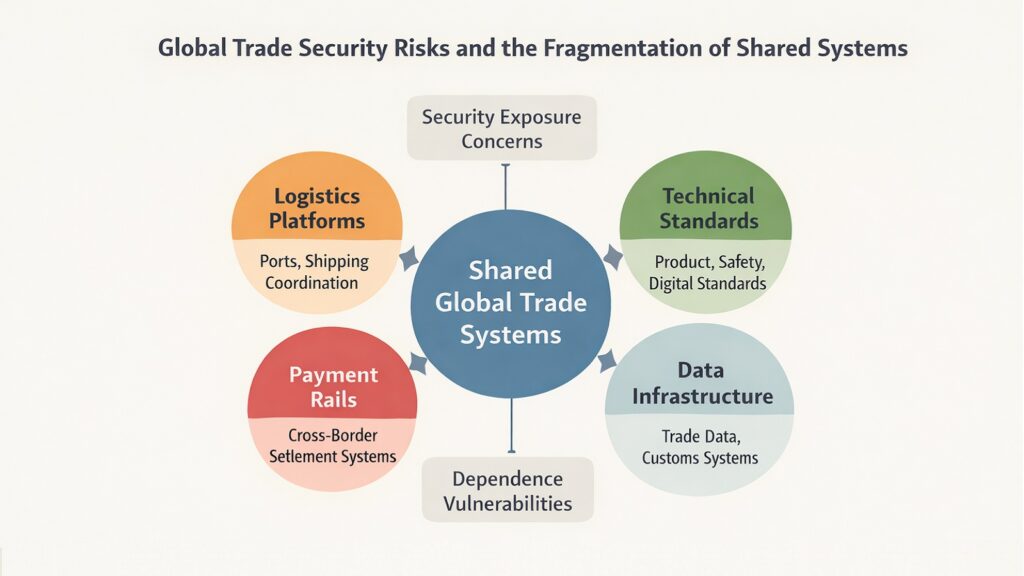

2. Global Trade Security Risks Disrupting Shared Global Systems

Global Trade Security Risks undermine the shared infrastructure that made global trade efficient. For decades, countries relied on common systems for logistics coordination, technical standards, payment processing, and data exchange. These worked because participants trusted them to remain neutral and accessible. That trust has eroded as major economies worry that shared platforms expose them to surveillance, disruption, or exclusion by rivals.

The response has been to build parallel systems. China developed its own satellite navigation network rather than depend on GPS. It created alternative payment rails to reduce reliance on dollar-dominated financial messaging. Russia explored similar redundancies after facing sanctions. The European Union pushes for digital sovereignty with its own cloud infrastructure. India invests in domestic alternatives to reduce dependence on foreign-controlled platforms.

Each parallel system makes sense from a security perspective. No country wants trade flows dependent on infrastructure that a rival could disable or monitor. But the cumulative effect fragments the global trading system. When countries use different satellite systems, payment networks, or data protocols, transactions become more complex and costly. Interoperability declines.

The fragmentation compounds over time. As parallel systems mature, they develop their own ecosystems of supporting services and regulatory frameworks. Switching becomes more expensive. Countries make investments that lock them into continued use. Network effects that once unified global commerce now operate within separate spheres, deepening the divide.

This disruption differs from simple trade barriers. Tariffs restrict what crosses borders but leave infrastructure intact. Parallel systems change the infrastructure itself. They create lasting incompatibilities that persist even if political tensions ease. Reunifying fragmented systems requires not just policy changes but technical overhauls and abandonment of sunk investments.

Global Trade Security Risks Driving Infrastructure Duplication

| Shared Global System | Security-Driven Alternative |

|---|---|

| GPS satellite navigation | BeiDou, Galileo, and regional positioning systems |

| SWIFT financial messaging | CIPS, SPFS, and bilateral payment channels |

| ICANN internet governance | National data localization and digital sovereignty laws |

| ISO technical standards | Competing national standards in telecommunications |

| Global shipping platforms | Regional logistics systems with limited cross-border visibility |

| Cloud computing | Sovereign cloud requirements and restricted data transfer |

| IP frameworks | Parallel patent systems and technology transfer restrictions |

| Credit rating agencies | Alternative assessment frameworks in emerging markets |

3. Global Trade Security Risks Disrupting Global Supply Chain Design

Global Trade Security Risks have forced a fundamental rethinking of supply chain structure. The optimization logic that dominated for decades prioritized cost reduction and inventory minimization. Firms built supply chains that stretched across continents and maintained minimal buffer stocks. This approach worked when the main risks were operational inefficiencies rather than geopolitical shocks.

Security concerns now override efficiency calculations. Firms and governments recognize that a supply chain optimized for cost can become a vulnerability when tensions rise. A single supplier in a politically unstable region can shut down production lines. Concentration in countries that might face sanctions creates an unacceptable risk.

The response has been a shift toward resilience and control. Companies add redundancy by maintaining multiple suppliers in different regions. They increase inventory to buffer disruptions. Governments push for reshoring or friend-shoring of critical production, even when domestic manufacturers cost more. The goal is to ensure that no single source can cripple essential supply chains.

This redesign shortens average supply chain distances and reduces supplier diversity. Regional concentration increases as firms consolidate sourcing within trusted zones. A company that once sourced semiconductors from Taiwan, rare earths from China, and assembly labor from Southeast Asia now considers moving assembly closer to end markets and developing alternative mineral supplies within allied territories.

The cumulative effect slows global trade and makes it more segmented. Supply chains that once spanned the world now loop within regions. Trade still occurs between groupings, but less at the intermediate goods level where security concerns bite hardest. Final products cross borders more easily than the components that go into making them.

Fragmentation accelerates because supply chain decisions create lasting commitments. Building a factory or developing a supplier relationship takes years and significant investment. Once firms reorganize around security priorities, reversing those decisions becomes expensive and slow. The new geography of production becomes entrenched.

Global Trade Security Risks Transforming Supply Chain Priorities

| Traditional Supply Chain Goal | Security-Driven Redesign |

|---|---|

| Minimize total production cost | Maximize supply continuity under stress |

| Single-source for scale economies | Multi-source across politically distinct regions |

| Just-in-time inventory | Strategic stockpiling of critical components |

| Offshore to lowest-wage markets | Nearshore or friend-shore to reduce exposure |

| Global footprint for market access | Regional concentration for control |

| Long-term supplier partnerships | Flexible sourcing to avoid dependency |

| Centralized production hubs | Distributed manufacturing closer to end markets |

| Complex multi-tier networks | Simplified chains with fewer geopolitical handoffs |

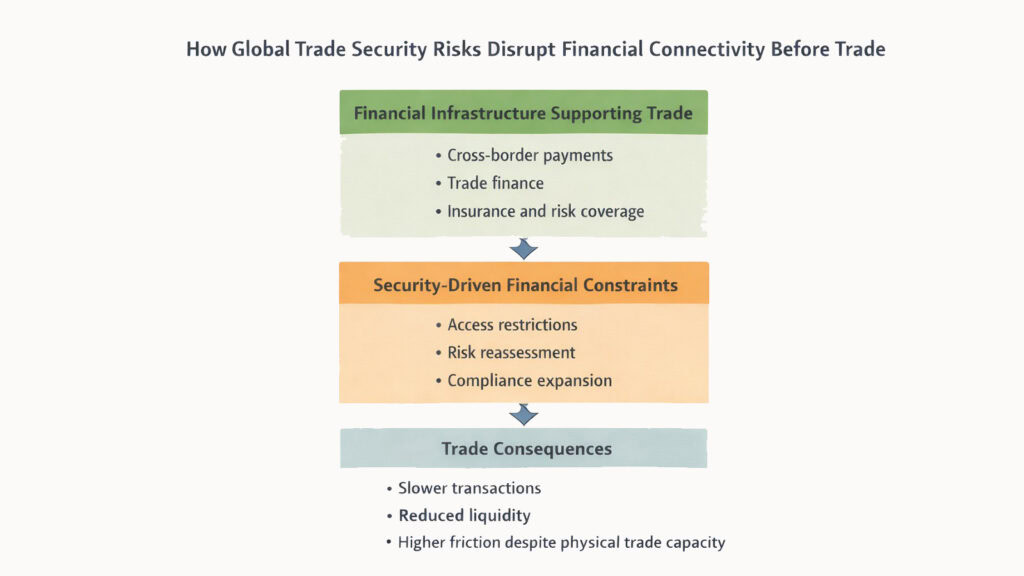

4. Global Trade Security Risks Disrupting Financial Connectivity

Global Trade Security Risks reach beyond physical goods to disrupt the financial infrastructure that enables trade. International payments, trade finance, currency exchange, and insurance all depend on systems that connect buyers and sellers across borders. When those systems face security threats or fragment along political lines, the financial foundation of trade weakens before goods stop moving.

Sanctions have become a primary tool through which financial connectivity breaks down. Excluding a country from international payment systems cuts it off from global trade more effectively than tariffs. The threat of sanctions pushes countries to develop alternative financial channels that bypass systems they perceive as controlled by potential adversaries. Secondary sanctions force firms to choose between different financial networks.

The rise of alternative payment systems reduces interoperability and increases transaction costs. A firm trading with partners in different blocs may need relationships with multiple banks, navigate different regulatory requirements, and accept currency exchange costs that would not exist in a unified system. Trade finance becomes harder when banks in different regions face conflicting compliance requirements.

Insurance and risk management costs rise as political risks become harder to assess and hedge. Traditional insurance assumed trade disruptions would be limited and temporary. Global Trade Security Risks create scenarios where disruptions could be prolonged and systematically targeted. Insurers either raise premiums or withdraw from certain markets.

Currency fragmentation adds another layer of friction. The dollar’s dominance in international trade has long provided a common unit of account. As countries seek financial autonomy, they promote alternative currencies for trade settlement. Bilateral arrangements replace multilateral systems. Global South Economies are increasingly settling bilateral trade in local currencies. The efficiency gains from having a single dominant currency erode.

Financial fragmentation often precedes physical trade disruption. A firm can adapt to higher tariffs by accepting lower margins. Adjusting to fragmented financial systems requires building new banking relationships and compliance capabilities. Many firms, particularly smaller ones, lack the resources to operate across multiple financial spheres and retreat to trading within their own bloc.

Global Trade Security Risks Fragmenting Trade Finance Infrastructure

| Traditional Financial System | Disruptions Emenating From Global Trade Security Risks |

|---|---|

| Dollar-dominated settlement | Bilateral currency arrangements and alternative reserve currencies |

| Universal banking access | Sanctions exclude entire countries from correspondent networks |

| Standardized letters of credit | Fragmented trade finance requiring multiple systems |

| Global insurance markets | Regional risk pools with limited cross-border coverage |

| Integrated payment networks | Parallel clearing systems reducing interoperability |

| Multilateral development banks | Competing infrastructure funds aligned with geopolitical blocs |

| Unified credit assessment | Divergent risk models based on political factors |

| Open capital markets | Investment screening and restrictions on cross-border flows |

5. Global Trade Security Risks Disrupting Economic Interdependence

Global Trade Security Risks push economies to deliberately reduce interdependence with rivals. This process, often called decoupling, unfolds gradually and selectively rather than through sudden breaks. Countries identify sectors where dependency creates vulnerability and take steps to build domestic alternatives or shift to more reliable partners. The goal is not complete autarky but strategic autonomy in critical areas.

Technology sectors face the most aggressive decoupling efforts. Advanced semiconductors, artificial intelligence, quantum computing, and biotechnology all attract restrictions on trade, investment, and knowledge exchange. Countries worry that dependency in these areas could undermine both economic competitiveness and national security. They invest in domestic capabilities even when nurturing those industries costs more than importing would.

The disruption extends beyond direct trade to affect investment patterns. Firms face pressure to avoid investing in countries that their home governments view as security risks. Venture capital, joint ventures, and technology partnerships all decline between rival blocs. Cross-border mergers face heightened scrutiny. The flow of capital that once tied economies together now faces barriers comparable to those on goods.

Technology transfer slows as countries restrict the movement of people and ideas. Visa restrictions limit which researchers can work in sensitive industries. Export controls block the sharing of technical knowledge. Universities face pressure to limit collaboration in strategically important fields. The informal networks through which innovation spreads globally become thinner.

Production planning changes as firms anticipate further decoupling. Rather than building integrated facilities serving global markets, companies create separate production systems for different geopolitical spheres. A technology firm might maintain one supply chain for Western markets and another for China. The duplication reduces economies of scale but protects against future restrictions.

Decoupling reshapes long-term economic structures rather than just current trade flows. When countries invest in domestic alternatives to replace imports, those investments create constituencies that benefit from continued protection. Industries that develop in response to security concerns lobby against reintegration even if political tensions ease.

Global Trade Security Risks Driving Strategic Decoupling

| Area of Interdependence | Decoupling Responses Due to Global Trade Security Risks |

|---|---|

| Semiconductor supply chains | Domestic chip manufacturing subsidies and export controls |

| Pharmaceutical ingredients | Regional production requirements and strategic stockpiles |

| Rare earth mineral sourcing | Alternative supply development and recycling investments |

| Manufacturing equipment | Technology transfer restrictions and foreign investment screening |

| AI development | Data localization and limits on algorithm sharing |

| Telecommunications | Vendor restrictions and parallel network buildouts |

| Battery technology | Subsidies tied to domestic content and allied sourcing |

| Space technology | Independent launch capabilities and technology protection |

6. Global Trade Security Risks Disrupting Trust as an Economic Input

Trust functions as a critical but often invisible input in global trade. Transactions rely on expectations that contracts will be honored, goods will meet specifications, payments will clear, and disputes will be resolved fairly. When trust erodes, these expectations weaken, and the costs of trade rise. Global Trade Security Risks steadily undermine trust by injecting political considerations into commercial relationships.

The erosion of trust shows up first in increased verification requirements. Buyers demand more extensive documentation and inspection. Sellers require more stringent payment guarantees. Both sides invest in compliance systems to demonstrate they meet increasingly complex regulations. What once required a handshake now demands lawyers, auditors, and insurance. Each verification step adds cost and delays transactions.

Regulatory burdens multiply as countries use trade rules to address security concerns. Export controls require firms to investigate their customers. Import screening examines not just product specifications but the political affiliations of suppliers. Data governance rules restrict how information can be shared across borders. Each new rule adds friction to trade.

Insurance costs rise to cover political risks that commercial insurance traditionally excluded. Firms once worried mainly about credit risk and logistics problems. Now they face risks that goods will be seized, contracts nullified, or assets frozen due to geopolitical events beyond their control. Pricing these risks leads to either very high premiums or market withdrawal.

The disruption of trust compounds other forces fragmenting trade. When traders doubt their counterparties or fear that political events will override contractual obligations, they retreat to partners they know. This typically means trading within their own region or ideological bloc, where legal systems and political risks feel more predictable. Longer-distance relationships become harder to sustain.

Trust erosion creates self-reinforcing dynamics. As fewer transactions occur between rival blocs, traders lose experience working with each other. Unfamiliarity breeds further caution. Disputes that might be resolved informally escalate into formal conflicts. Negative experiences spread through business networks and discourage others from attempting similar trades.

Rebuilding trust after it has been damaged proves extremely difficult. Trust accumulates slowly through repeated successful interactions but can be destroyed quickly. Even if political tensions ease, the memory of disrupted supply chains or frozen assets lingers. Firms build redundancies to avoid future dependency, making reintegration less likely.

Global Trade Security Risks Eroding Trust in Trade Relationships

| Traditional Trust Mechanism | Security-Driven Erosion |

|---|---|

| International arbitration | Concerns that rulings favor certain political blocs |

| Reputation systems | Fragmentation limits information flow across regions |

| Commercial risk insurance | Political risks become uninsurable or prohibitively expensive |

| Neutral logistics services | Fears of surveillance or seizure by rival governments |

| Technical standards | Standards setting becomes geopolitically contested |

| Professional verification | Auditors face conflicting requirements from different jurisdictions |

| Long-term partnerships | Strategic reassessments lead to sudden terminations |

| Mutual economic gain | Security concerns override profit motives in critical sectors |

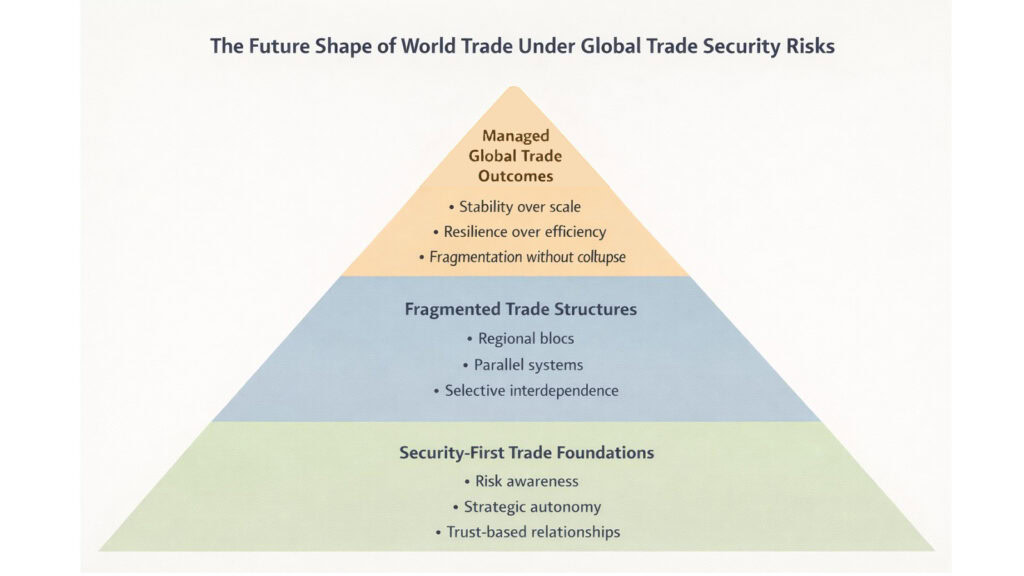

Conclusion: Global Trade Security Risks Disrupting the Future of World Trade

Global Trade Security Risks have moved from episodic disruptions to permanent constraints that shape how trade operates. The six forces examined here demonstrate that fragmentation stems from security concerns working through multiple channels simultaneously. Trusted partnerships fragment into regional clusters. Shared systems are split into parallel infrastructure. Supply chains reorganize around resilience. Financial connectivity weakens along political lines. Economic interdependence is reduced through strategic decoupling. Trust erodes under verification and political risk.

These forces interact and reinforce each other. Financial fragmentation makes supply chain reorganization more urgent. Weakened trust accelerates retreat to regional partnerships. Parallel systems reduce the efficiency gains that made global integration attractive. Each force compounds the others, creating momentum toward fragmentation that proves difficult to reverse.

The future of world trade will not resemble either the integrated system of recent decades or a complete breakdown into autarkic blocs. Instead, trade will operate through a more fragmented architecture where security considerations constrain but do not eliminate cross-border exchange. Certain sectors will remain globally integrated where security concerns are minimal. Others will fragment almost completely. Most will fall somewhere between, with trade continuing through narrower channels at higher costs.

This outcome represents managed fragmentation rather than collapse. Countries accept reduced efficiency in exchange for greater control and perceived stability. They maintain some connections across political divides while thickening relationships within their own spheres. The result is a trading system that functions but delivers less growth, less innovation diffusion, and less poverty reduction.

The challenge for policymakers and business leaders will be navigating this fragmented landscape while preserving as much openness as security concerns allow. That requires distinguishing between genuine security risks and protectionist impulses. It means building redundancy without complete duplication, maintaining connections across divides, and preserving institutions that can facilitate cooperation even when trust is limited.

Global Trade Security Risks will define trade architecture for the foreseeable future. The question is not whether fragmentation will occur but how much different countries and sectors will accept and how effectively they can manage the resulting complexities. The decisions made in response to security concerns today will shape economic possibilities for decades to come.

Global Trade Security Risks and the Transition to Fragmented Trade Architecture

| Aspect of Global Trade | Shift Driven by Security Risks |

|---|---|

| Trade volume growth | Slower expansion as efficiency-driven gains diminish |

| Geographic patterns | Regional concentration replacing global dispersal |

| Sectoral integration | Critical industries fragment while consumer goods remain integrated |

| Investment flows | Capital increasingly constrained by security screening |

| Innovation diffusion | Knowledge transfer slows between rival technological spheres |

| Institutional framework | Multilateral bodies weaken as regional arrangements strengthen |

| Transaction costs | Rising due to parallel systems and verification requirements |

| Policy priorities | Security and resilience elevated above cost minimization |