Table of Contents

Introduction: Why Market Research Holds the Key to Consumer Minds

Every business believes it understands its customers. Yet most companies rely on surface observations while deeper psychological currents remain invisible beneath everyday transactions. Market Research serves as the marketing function that penetrates these hidden layers of consumer consciousness. It reveals what people cannot articulate and exposes motivations they barely recognize in themselves.

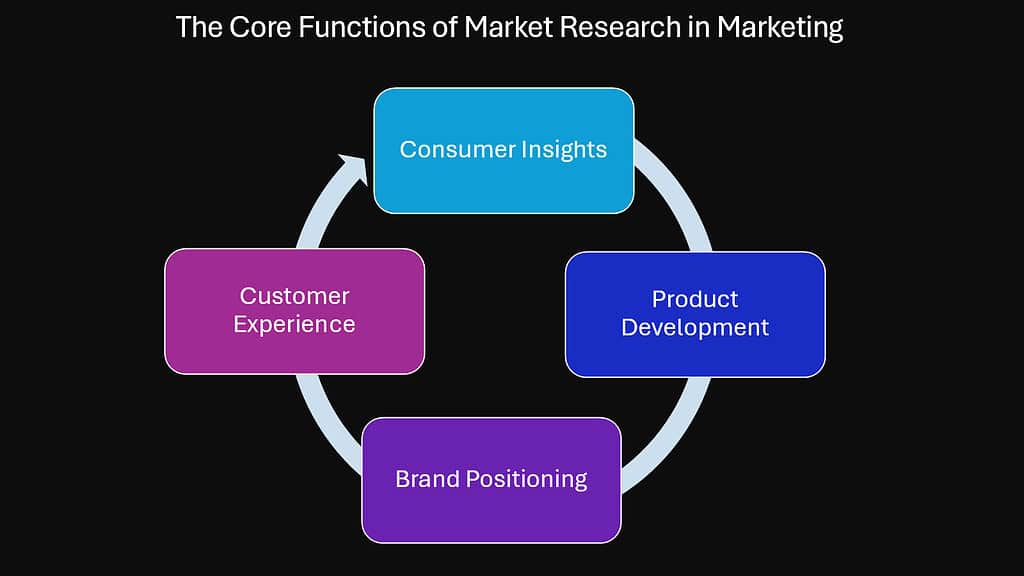

The discipline extends far beyond collecting feedback or measuring satisfaction scores. Market Research functions as a systematic investigation into human behavior under commercial contexts. It maps the terrain where emotions intersect with purchasing decisions and where cultural values shape brand perceptions. While other marketing functions execute strategies or manage communications, Market Research provides the foundational intelligence that makes those efforts meaningful rather than speculative.

Consider how consumers rarely explain their true reasons for choosing one product over another. They offer rational justifications while unconscious factors drive their hands toward specific shelves. They claim price matters most yet consistently pay premiums for brands that resonate emotionally. This gap between stated preferences and actual behavior creates the space where Market Research delivers its greatest value.

The psychology embedded in consumer minds operates through patterns that trained researchers can detect and decode. Emotional triggers hide within casual conversation. Cultural assumptions surface through unexpected hesitations. Behavioral inconsistencies point toward unmet needs that consumers cannot name. The six powerful methods explored in this article reveal how Market Research transforms these subtle signals into actionable business intelligence.

These approaches move beyond conventional surveys and focus groups. They examine what people avoid saying as carefully as what they declare. They study real-world actions instead of hypothetical scenarios. They blend technological precision with human insight to capture the full complexity of consumer decision-making. Together, these methods position Market Research as an essential compass for navigating markets where consumer minds remain the ultimate mystery to solve.

Table 1: Market Research Compared with Key Marketing Functions

| Marketing Functions | Relationship to Market Research |

|---|---|

| Market Research | Core investigative function that informs all others |

| Consumer Insight | Depends on Market Research for raw data and validation |

| Brand Management | Uses Market Research to track brand performance |

| Product Positioning | Relies on Market Research for positioning opportunities |

| Pricing Strategy | Requires Market Research for willingness-to-pay studies |

| Promotion and Advertising | Uses Market Research for creative testing and impact |

| Content Marketing | Depends on Market Research for topic relevance |

| Digital Marketing and Performance Analytics | Complements Market Research with real-time insights |

| Sales Enablement and Lead Generation | Uses Market Research to understand buyer journey |

| Customer Relationship Management | Integrates Market Research for satisfaction monitoring |

| Distribution and Channel Strategy | Applies Market Research for channel preferences |

1. Market Research Secrets: Reading Emotions Beyond Words

Consumers rarely purchase products through pure logic. Emotions guide their hands even when rational thinking constructs post-purchase justifications. Market Research excels at detecting these emotional undercurrents that flow beneath conscious awareness. The discipline employs various qualitative methods to capture feelings that surveys with checkbox options cannot measure.

Skilled researchers listen for voice inflections during interviews. They notice when respondents lean forward with genuine excitement or pull back with subtle discomfort. Focus groups reveal emotional dynamics through group interactions where one person’s enthusiasm triggers others or where collective silence signals shared reservation. These emotional signals often contradict what participants claim about their preferences.

Several brands have built competitive advantages by reading emotions accurately. When Dove launched its Real Beauty campaign, the company conducted extensive research revealing that women felt excluded by conventional beauty advertising. This emotional insight about inadequacy and desire for authenticity transformed how personal care products connected with consumers. The campaign resonated because it addressed feelings women experienced but rarely discussed openly.

Maslow’s Hierarchy of Needs provides a valuable framework for understanding how Market Research uncovers emotional drivers. The hierarchy progresses from physiological needs through safety, belonging, esteem, and self-actualization. Consumer emotions align with these levels in ways that shape purchasing behavior. Someone buying organic food might satisfy physiological needs while simultaneously addressing safety concerns about pesticides. A luxury car purchase fulfills esteem needs wrapped in emotions about status and achievement.

Market Research reveals which hierarchical level truly motivates specific consumer segments. A fitness brand might discover that customers seek belonging through community rather than physiological health improvements. Insurance companies find that customers want emotional security more than statistical risk reduction. Technology products often promise self-actualization through creativity and personal expression. These emotional layers become visible only through careful research that probes beyond surface features and functional benefits.

The hierarchy also explains why emotional responses shift across different life stages and circumstances. Young professionals might prioritize esteem needs while parents focus on safety and belonging. Economic uncertainty pushes consumers toward lower hierarchy levels regardless of income. Market Research captures these emotional transitions and helps brands adjust their messaging accordingly.

Table 2: Maslow’s Hierarchy Applied to Market Research Emotional Discovery

| Hierarchy Level | Core Emotional Needs | Consumer Behavior Expression | Market Research Approach | Brand Example |

|---|---|---|---|---|

| Physiological | Survival, health, basic comfort | Purchases focused on sustenance and physical wellbeing | Ethnographic observation of daily routines and consumption patterns | Grocery retailers studying shopping basket compositions |

| Safety | Security, stability, protection | Risk-averse choices and preference for trusted brands | Depth interviews exploring anxiety and fear triggers | Insurance firms uncovering worry points beyond policy features |

| Belonging | Connection, acceptance, community | Brand loyalty driven by social identity | Focus groups revealing tribal affiliations and social validation | Harley-Davidson discovering emotional attachment to rider community |

| Esteem | Achievement, recognition, status | Conspicuous consumption and premium preferences | Projective techniques exposing self-image aspirations | Luxury automotive brands identifying status symbols that matter |

| Self-Actualization | Personal growth, creativity, purpose | Values-based purchasing and ethical consumption | Narrative interviews about life goals and personal meaning | Patagonia learning customers seek environmental contribution |

2. Market Research Secrets: Decoding the Silence in Feedback

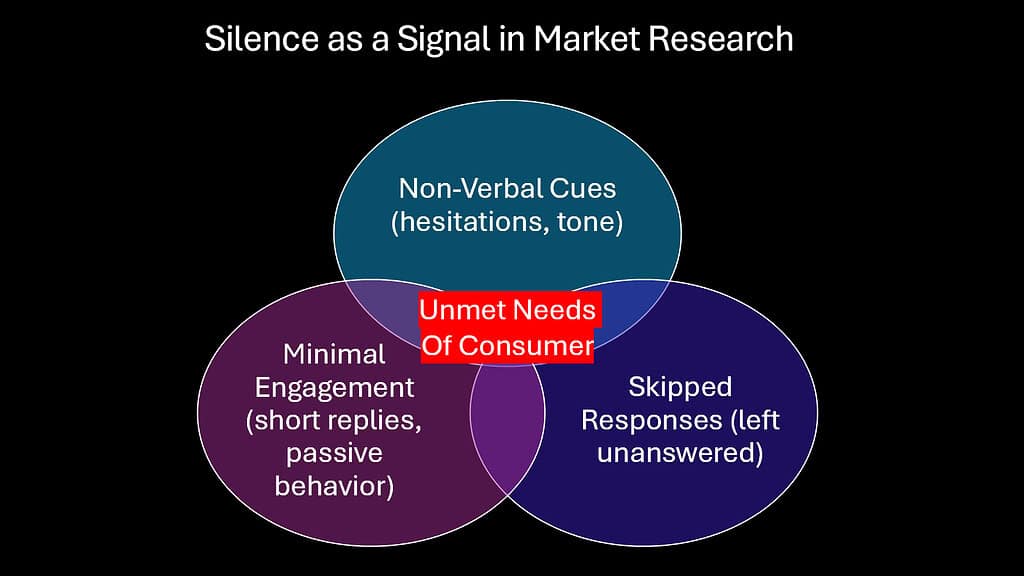

What consumers refuse to say often matters more than their explicit statements. Silence carries meaning that trained researchers learn to interpret. When survey respondents skip questions or focus group participants suddenly grow quiet, these gaps in communication signal discomfort, confusion, or hidden concerns that merit investigation.

Qualitative Market Research particularly excels at noticing these unspoken messages. An interviewer might ask about pricing and receive a long pause before the answer arrives. That hesitation reveals internal conflict or uncertainty that straight responses would mask. Similarly, when consumers avoid discussing certain product features, their avoidance itself becomes valuable information about potential problems or unmet expectations.

Non-verbal cues complement silence in face-to-face research settings. Crossed arms might indicate defensiveness when discussing a brand. Fidgeting can signal discomfort with a proposed concept. Eye contact patterns shift when respondents discuss topics they find embarrassing or sensitive. These physical reactions provide honest feedback even when words remain diplomatic or evasive.

The strategic value of silence emerges when it reveals market gaps that competitors overlook. If customers consistently avoid mentioning a product category during lifestyle discussions, that absence suggests the category lacks relevance or fails to integrate naturally into their lives. When respondents struggle to articulate why they switched brands, their difficulty points toward subconscious dissatisfaction that competitors could address.

Digital environments create new forms of silence worth studying. Abandoned shopping carts represent silent rejection at critical decision moments. Low engagement with certain content types signals disinterest despite what surveys might report about topic preferences. Time spent hovering over options without clicking reveals consideration patterns and hesitation points.

Researchers decode silence by creating safe spaces for honest communication. They build rapport that encourages vulnerability. They use indirect questioning that allows respondents to project feelings onto hypothetical situations rather than admit them directly. They observe behavioral silence through tracking studies that record what people do rather than what they claim.

The patterns hidden in silence often expose uncomfortable truths about products or services. Customers might silently tolerate poor experiences rather than complain, creating an illusion of satisfaction until they suddenly defect. They might privately question a brand’s values while publicly supporting it. Market Research that decodes these silences helps businesses address problems before they escalate into crises.

Table 3: Types of Silence in Market Research and Their Strategic Meanings

| Silence Type | Research Context | Possible Interpretations | Business Implication | Detection Method |

|---|---|---|---|---|

| Hesitation Pause | Interview question about pricing or value | Internal conflict between desire and affordability | Pricing strategy needs adjustment or financing options | Audio analysis of interview timing patterns |

| Question Avoidance | Skipped survey items on specific features | Confusion about feature or lack of relevance | Product communication unclear or feature unnecessary | Survey completion pattern analysis |

| Topic Deflection | Steering conversation away from specific subjects | Discomfort with brand associations or product experience | Reputation issue or negative sentiment requiring address | Qualitative coding of conversation flow |

| Collective Quiet | Focus group silence after concept presentation | Group rejection or lack of enthusiasm | Concept requires fundamental rethinking | Facilitator observation and group dynamic analysis |

| Digital Abandonment | Incomplete online transactions or forms | Friction in user experience or trust concerns | Website optimization needed or security signals missing | Behavioral analytics and session recording |

| Absent Discussion | Product never mentioned in lifestyle conversations | Category irrelevance or low engagement | Marketing strategy failing to create mental availability | Ethnographic diary studies and natural observation |

| Delayed Response | Long gap before answering satisfaction questions | Searching for diplomatic answer rather than honest reaction | Customer experience problems masked by politeness | Interview pacing analysis and non-verbal observation |

3. Market Research Secrets: Turning Bias into Strategic Insight

Every research study carries inherent biases that shape findings in subtle ways. Rather than pretend objectivity exists, sophisticated Market Research acknowledges these biases and transforms them into strategic advantages. Confirmation bias leads researchers to notice evidence supporting existing beliefs while overlooking contradictions. Cultural bias causes misinterpretation of behaviors across different societies. Sampling bias creates skewed results when study participants fail to represent broader populations.

The recognition of bias actually improves research quality when handled properly. Researchers who expect bias design studies that counteract its effects. They include diverse team members who challenge assumptions. They test hypotheses from multiple angles instead of seeking single confirming data points. They report findings with appropriate caveats about limitations and alternative interpretations.

Prospect Theory offers a powerful framework for understanding how bias operates in research contexts. Developed by Kahneman and Tversky, this theory explains how people evaluate potential gains and losses asymmetrically. Individuals fear losses more intensely than they value equivalent gains. This risk perception bias influences how consumers respond to research questions about new products, pricing changes, or brand switches.

When researchers ask consumers about willingness to try a new product, loss aversion biases the responses. Participants overweight potential disappointment or wasted money compared to possible satisfaction. This makes research findings overly conservative unless researchers account for the bias. Smart companies recognize that actual adoption rates often exceed stated intentions once the product enters the market and social proof reduces perceived risk.

Reference point bias similarly affects research outcomes. Consumers evaluate options relative to their current situation rather than absolute terms. A price increase feels like a loss, even if the new price remains competitive. A product improvement seems modest if the baseline already exceeded expectations. Market Research that understands these reference points can better predict actual market reactions.

Framing effects demonstrate how question wording shapes responses through bias. Asking if consumers would avoid a product with certain risks generates different answers than asking if they would choose a product with certain benefits. Both questions describe identical situations yet trigger different mental frameworks. Skilled researchers test multiple framings to understand which biases operate most strongly.

Companies can leverage these biases strategically once Market Research exposes them. A brand launching a premium product might emphasize what consumers lose by choosing cheaper alternatives rather than highlighting premium features. A service trying to encourage switching might frame the decision as gaining new capabilities rather than abandoning familiar tools. The research reveals which frames resonate most powerfully with target segments.

Table 4: Prospect Theory Biases in Market Research Applications

| Bias Type | Psychological Mechanism | Impact on Research Responses | Strategic Business Application | Research Design Adjustment |

|---|---|---|---|---|

| Loss Aversion | Losses feel twice as impactful as equivalent gains | Consumers overstate resistance to change and switching costs | Frame offers as avoiding losses rather than gaining benefits | Include questions about both gain and loss scenarios |

| Reference Point Dependency | Judgments relative to current state rather than absolute | Price sensitivity varies based on current spending baseline | Establish context before presenting new concepts | Map existing reference points before testing innovations |

| Diminishing Sensitivity | Marginal value decreases as amounts increase | Additional features show declining appeal beyond threshold | Focus development on meaningful improvements not incremental | Test satisfaction curves to identify diminishing returns |

| Probability Weighting | Overweight small probabilities and underweight large ones | Rare risks and unlikely benefits receive disproportionate attention | Marketing can emphasize low-probability aspirational outcomes | Use behavioral observation to supplement stated preferences |

| Endowment Effect | Owned items valued higher than identical non-owned items | Current customers overvalue existing product compared to alternatives | Create ownership feeling through trials and samples | Compare current users with non-users in separate samples |

| Mental Accounting | Money treated differently based on source or purpose | Purchase decisions vary by payment method or budget category | Position products within favorable mental accounts | Explore spending categories and payment preferences |

4. Market Research Secrets: Observing Behavior in Real Environments

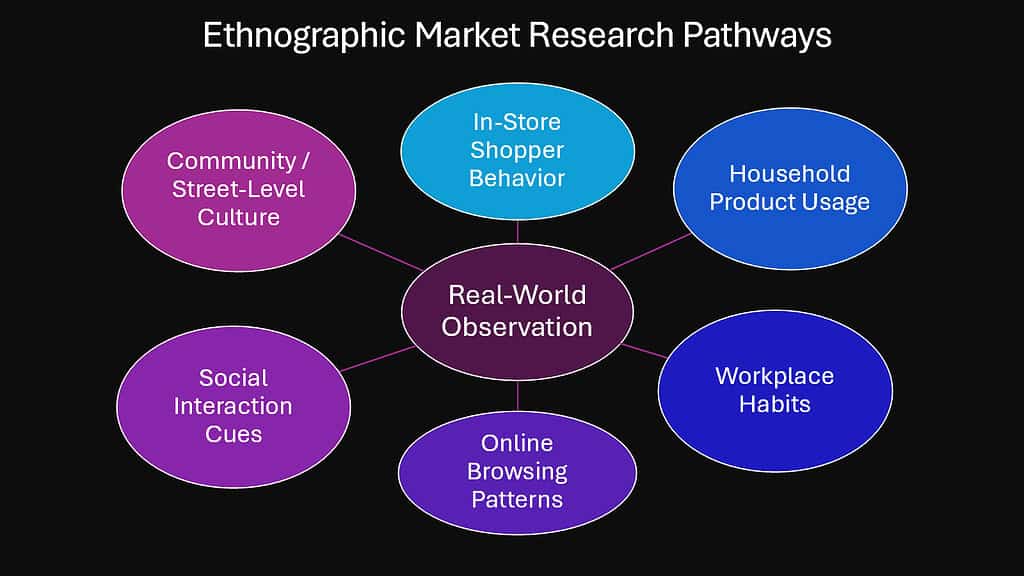

Surveys and interviews capture what people say while ethnographic observation reveals what they actually do. This distinction matters enormously because consumer behavior often contradicts stated intentions. People claim they read nutrition labels carefully but cameras show they glance for seconds. They describe elaborate decision processes yet observations show impulse choices. Market Research through real-world observation cuts through these discrepancies.

Ethnographic methods borrowed from anthropology allow researchers to study consumers in natural settings. Trained observers visit homes, accompany shoppers through stores, or monitor online communities without intrusive questioning. They document routines, notice workarounds, and identify pain points that consumers have normalized to the point of forgetting they exist.

A classic example comes from Procter & Gamble researchers who observed how people cleaned their homes. They noticed consumers used multiple products for single tasks and struggled with storage. These observations led to product innovations like Swiffer that simplified cleaning routines. The insights emerged not from asking what people wanted but from watching what they struggled with.

Retail environments offer rich opportunities for behavioral observation. Researchers track shopping paths through stores using various technologies. They measure how long consumers examine different products and which packaging designs capture attention. They observe decision patterns like comparing two options repeatedly before choosing or grabbing items without hesitation. These behaviors reveal cognitive processes that consumers cannot articulate when asked directly.

Digital environments enable observation at unprecedented scale. Clickstream data shows actual navigation patterns through websites. A/B testing observes how different designs change conversion behavior. Social media monitoring watches conversations unfold naturally without research prompts. These methods capture behavior as it happens rather than filtered through memory and self-presentation.

The Japanese economy particularly embraced observational research through concepts like gemba, meaning the actual place where value creation occurs. Japanese manufacturers sent engineers to customer sites to observe product usage directly. This approach revealed how customers adapted products in unexpected ways or encountered problems during real applications. The insights drove product improvements that surveys would never have identified.

Indian companies similarly employ observation to understand diverse consumer contexts. Rural market research often involves living in villages to comprehend daily rhythms and consumption patterns. Urban researchers observe shopping behavior across different retail formats from street markets to malls. This environmental context proves essential in markets where consumer behavior varies dramatically across segments.

Table 5: Observational Research Methods and Business Applications

| Method | Environment | Key Insights Captured | Industry Application | Notable Example |

|---|---|---|---|---|

| Home Ethnography | Consumer residences and personal spaces | Product usage patterns, storage solutions, family dynamics | Consumer packaged goods and home appliances | IDEO observing hospital patient experiences for improved medical devices |

| Shop-Along Studies | Retail stores during actual shopping | Decision triggers, navigation patterns, packaging impact | Retail design and brand positioning | Grocery chains optimizing shelf placement based on traffic flow |

| Digital Behavioral Tracking | Websites and mobile applications | Click patterns, abandonment points, feature usage | User experience design and conversion optimization | Amazon observing browse-to-purchase paths for recommendation engines |

| Workplace Observation | Professional environments | Workflow inefficiencies, collaboration patterns, tool usage | Business software and productivity solutions | Microsoft studying office work patterns for Teams development |

| Community Immersion | Social groups and online forums | Language usage, value systems, peer influence | Brand messaging and community building | Gaming companies observing player interactions for engagement design |

| Usage Diary Studies | Multiple contexts over extended periods | Frequency patterns, situational variations, habit formation | Product development and service design | Fitness brands tracking workout habits for app feature prioritization |

5. Market Research Secrets: Spotting Hidden Trends Before They Explode

Markets transform constantly as cultural values shift and lifestyle preferences evolve. Companies that detect these changes early capture opportunities while competitors scramble to catch up. Market Research serves as an early warning system that identifies weak signals before they amplify into major trends. These signals appear in unexpected places among small groups who foreshadow broader adoption.

The Diffusion of Innovations Theory elucidates the process by which novel concepts disseminate among populations. Developed by Everett Rogers, this framework identifies five adopter categories: innovators, early adopters, early majority, late majority, and laggards. Each group exhibits distinct characteristics and motivations. Innovators embrace novelty for its own sake while early adopters seek competitive advantages. The early majority waits for proven benefits while late majority requires social pressure to change.

Market Research focused on trend spotting concentrates attention on innovators and early adopters. These leading segments experiment with emerging behaviors years before mainstream acceptance. They try new products, adopt different consumption patterns, and express values that eventually become widespread. Identifying and studying these groups provides advance notice of coming market shifts.

The European organic food movement demonstrates this pattern clearly. Small groups of environmentally conscious consumers began demanding organic products during the nineteen seventies and eighties. Market Research tracking these early adopters revealed motivations around health, sustainability, and food quality. Companies that recognized this trend early built organic product lines that positioned them advantageously when the movement reached mainstream European markets.

Technology adoption in the United States follows similar diffusion patterns. Personal computers initially attracted hobbyists and technology enthusiasts. Market Research among these innovators revealed use cases and frustrations that guided product development. As early adopters in business contexts discovered productivity benefits, researchers documented which applications drove adoption. This intelligence helped companies understand how to cross into early majority segments.

Cultural trends often emerge from youth subcultures before spreading demographically. Fashion movements, music genres, and communication styles begin with small groups who seek differentiation. Market Research monitoring these communities spots emerging aesthetic preferences and value systems. Brands that connect with these trends early build authentic relationships with consumers who later influence broader populations.

The challenge involves distinguishing genuine trends from temporary fads. Market Research examines whether emerging behaviors align with deeper societal shifts or represent superficial novelty. Sustainable trends connect to fundamental human needs, economic changes, or technological capabilities. Fads generate excitement without solving real problems or fitting within broader lifestyle evolution.

Table 6: Innovation Diffusion Segments and Market Research Strategies

| Adopter Category | Population Share | Key Characteristics | Research Focus | Business Strategy | Timing Advantage |

|---|---|---|---|---|---|

| Innovators | Two to three percent | Risk-tolerant, technology enthusiasts, comfortable with uncertainty | Monitor experimental behaviors and bleeding-edge preferences | Develop prototypes and gather technical feedback | Three to five years ahead of mainstream |

| Early Adopters | Thirteen to fifteen percent | Opinion leaders, value competitive advantage, willing to pay premium | Study use cases and articulated benefits | Refine positioning and build advocacy programs | Two to three years ahead of mainstream |

| Early Majority | Thirty to thirty-five percent | Pragmatic, need proven benefits, influenced by peer adoption | Track barriers to adoption and required evidence | Scale production and distribution for broader reach | Six months to one year ahead of peak |

| Late Majority | Thirty to thirty-five percent | Skeptical, cost-conscious, adopt due to social pressure | Understand concerns and price sensitivity | Optimize costs and emphasize widespread acceptance | At or past peak adoption |

| Laggards | Fifteen to eighteen percent | Traditional, resistant to change, adopt only when necessary | Minimal research attention unless mandatory transition | Maintain legacy options or manage discontinuation | Post-peak, declining relevance |

6. Market Research Secrets: Combining AI Power with Human Intuition

Artificial intelligence transforms Market Research through unprecedented data processing capabilities. Machine learning algorithms analyze thousands of survey responses in minutes. Natural language processing extracts themes from open-ended feedback automatically. Predictive models identify patterns across massive datasets that humans could never detect manually. This technological power accelerates research cycles and reveals insights hidden in complexity.

Yet artificial intelligence carries limitations that human intuition complements perfectly. Algorithms optimize for patterns within existing data but struggle with truly novel situations. They process language literally while missing cultural nuances and contextual meanings. They identify correlations without understanding causal mechanisms or emotional significance. The strongest Market Research combines computational power with human judgment.

Human researchers bring cultural knowledge that algorithms lack. They recognize when responses reflect social desirability rather than honest opinions. They understand historical context that shapes current attitudes. They detect subtle emotional cues that transcend word choice. They generate creative hypotheses that direct analysis toward meaningful questions rather than mechanical pattern searches.

Several companies demonstrate the power of hybrid approaches. Netflix uses algorithms to analyze viewing behavior across millions of subscribers, identifying content preferences and optimal recommendation timing. Human researchers then conduct qualitative studies exploring why certain genres resonate emotionally and how viewing fits within daily routines. The combination guides both algorithm refinement and original content development.

Consumer packaged goods companies similarly blend approaches. Artificial intelligence processes social media conversations at scale, flagging emerging topics and sentiment shifts. Human analysts then investigate context around these signals through traditional research methods. They understand whether negative sentiment reflects temporary complaints or fundamental brand problems. They recognize when positive buzz represents authentic enthusiasm or manufactured marketing.

Financial services firms employ artificial intelligence for fraud detection and risk assessment while using human researchers to understand customer financial behaviors and anxieties. The algorithms identify statistical anomalies but humans comprehend life circumstances that drive financial decisions. This combination improves both operational efficiency and strategic customer understanding.

The future of Market Research lies in thoughtful integration rather than wholesale automation. Artificial intelligence handles repetitive analysis and large-scale pattern detection. Humans focus on interpretation, cultural context, and strategic recommendations. They design studies that artificial intelligence then executes and they make sense of findings that algorithms surface. This partnership leverages the strengths of both approaches.

Researchers must develop new skills as artificial intelligence capabilities expand. They need sufficient technical understanding to work effectively with data scientists. They must ask questions that algorithms can address through available data. They should interpret algorithmic outputs critically rather than accepting results blindly. The role evolves from data processor to strategic translator between technology and business decision-making.

Table 7: AI and Human Capabilities in Market Research

| Research Task | AI Strengths | AI Limitations | Human Strengths | Human Limitations | Optimal Hybrid Approach |

|---|---|---|---|---|---|

| Survey Analysis | Process thousands of responses quickly, identify statistical patterns | Miss contextual nuances and cultural meanings | Interpret responses within cultural and strategic context | Cannot process large volumes efficiently | AI handles initial pattern detection, humans interpret strategic implications |

| Sentiment Detection | Analyze social media at scale, track sentiment trends | Struggle with sarcasm, cultural references, contextual meaning | Understand emotional subtlety and cultural context | Cannot monitor conversations comprehensively | AI monitors volume and flags anomalies, humans investigate significant signals |

| Consumer Segmentation | Identify behavioral clusters in large datasets | Create segments without understanding motivations | Develop psychographic profiles with explanatory depth | Limited by sample sizes and analytical capacity | AI identifies statistical segments, humans enrich with qualitative understanding |

| Trend Forecasting | Detect early signals in noisy data | Cannot distinguish meaningful trends from random variation | Apply domain expertise and cultural knowledge | Influenced by personal biases and limited data access | AI surfaces potential trends, humans evaluate plausibility and significance |

| Interview Analysis | Transcribe and code responses consistently | Miss non-verbal cues and emotional undercurrents | Detect hesitation, emotion, and unspoken messages | Inconsistent coding and limited capacity | AI handles transcription and initial coding, humans analyze depth interviews |

| Predictive Modeling | Build complex models with numerous variables | Generate predictions without causal explanations | Understand business context and causal mechanisms | Cannot test unlimited scenarios efficiently | AI generates predictions, humans validate through business logic and testing |

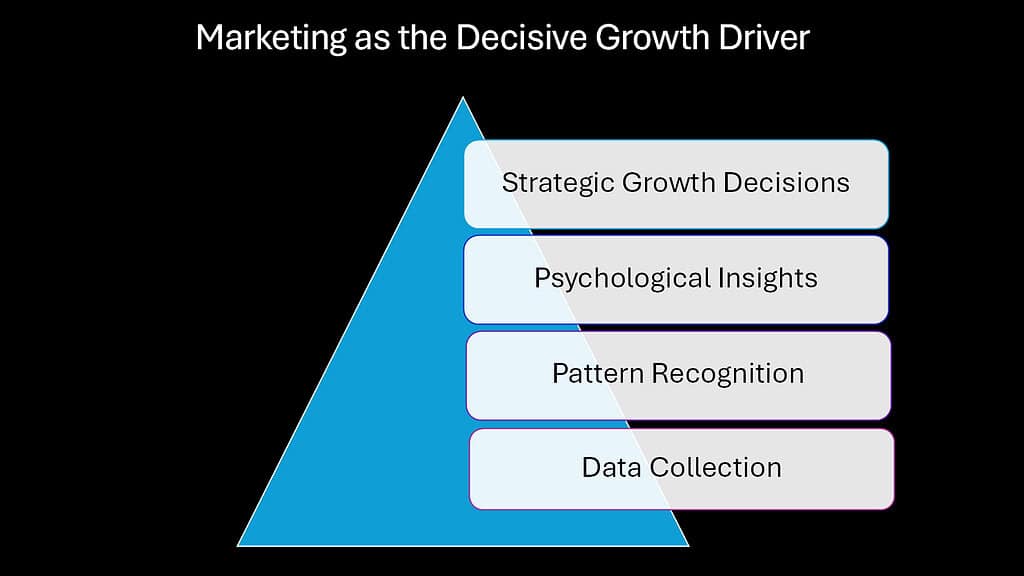

Conclusion: Market Research as the Ultimate Decoding Tool for Growth

The six secrets explored throughout this article reveal Market Research as far more than routine data collection. It functions as a sophisticated decoding system that translates hidden consumer psychology into actionable business intelligence. Reading emotions beyond words exposes the feelings that truly drive purchasing decisions. Decoding silence uncovers the discomfort and gaps that consumers cannot articulate. Turning bias into insight transforms research limitations into strategic advantages through frameworks like Prospect Theory.

Observing behavior in real environments captures the truth of consumer actions rather than filtered recollections. Spotting hidden trends before explosion positions businesses ahead of market shifts by focusing on innovators and early adopters as the Diffusion of Innovations Theory suggests. Combining artificial intelligence power with human intuition creates research capabilities that neither approach achieves independently.

These methods collectively position Market Research as an essential marketing function that informs every other business activity. Consumer insights derive from research foundations. Brand management requires research to track equity and perception. Product positioning depends on research to identify competitive opportunities. Pricing strategy builds on research about value perception and willingness to pay. All marketing execution ultimately rests on understanding consumers deeply enough to connect meaningfully.

The businesses that thrive treat Market Research as a growth compass rather than a compliance checkbox. They invest in understanding consumer minds systematically. They recognize that surface data misleads while deeper psychological investigation reveals truth. They appreciate that consumer behavior contains patterns that careful research can expose and decode.

Markets reward companies that solve problems consumers experience but cannot name. They favor brands that connect emotionally even when logical alternatives exist. They propel products that address emerging needs before mainstream awareness develops. Market Research provides the tools to identify these opportunities consistently rather than stumbling upon them accidentally.

The discipline requires both rigorous methodology and creative interpretation. It demands skepticism about obvious answers and curiosity about contradictions. It benefits from diverse perspectives that challenge assumptions and explore alternative explanations. It improves through continuous learning as markets evolve and research techniques advance.

Organizations should view Market Research investments as strategic imperatives rather than discretionary expenses. The insights generated guide resource allocation, prevent costly mistakes, and identify opportunities competitors overlook. The return compounds over time as accumulated consumer understanding builds institutional knowledge that informs faster and better decisions.

The future belongs to businesses that decode consumer minds more effectively than rivals. Market Research provides the methodology to achieve this competitive advantage. Companies that master these six secrets position themselves to anticipate shifts, satisfy unspoken needs, and build lasting connections with the consumers they serve.

Table 8: Market Research Value Across Business Decisions

| Business Decision Type | Research Input Required | Outcome Without Research | Outcome With Strong Research | Competitive Advantage |

|---|---|---|---|---|

| New Product Development | Unmet needs, feature priorities, concept validation | High failure rates from misaligned offerings | Products matching actual consumer needs and desires | First-mover advantage with proven demand |

| Brand Strategy | Perception gaps, emotional associations, competitive positioning | Generic messaging failing to differentiate | Authentic positioning resonating with target emotions | Stronger brand equity and premium pricing power |

| Market Entry | Consumer behaviors, cultural nuances, competitive landscape | Cultural missteps and misaligned value propositions | Localized offerings fitting market context | Faster adoption and market share gains |

| Pricing Decisions | Value perception, willingness to pay, competitive sensitivity | Revenue loss from suboptimal pricing | Optimized pricing capturing maximum value | Improved profitability without demand sacrifice |

| Marketing Communications | Message resonance, media consumption, creative effectiveness | Wasted spending on ineffective campaigns | Efficient investment in proven messages and channels | Higher return on marketing investment |

| Customer Experience Design | Pain points, preference priorities, emotional drivers | Improvements addressing wrong issues | Focused enhancements on high-impact elements | Superior satisfaction and loyalty outcomes |

| Strategic Planning | Market trends, competitive threats, opportunity assessment | Reactive responses to visible changes | Proactive positioning ahead of market shifts | Sustainable competitive advantage through anticipation |