Table of Contents

Introduction: Share Market Basics – Market’s Hidden Blueprint

Most people glance at stock tickers and see numbers dancing across screens. They watch prices climb and fall like waves against a shore. But beneath that visible movement lies something far more intricate. Share Market Basics reveal an invisible architecture where eight distinct components work together like parts in a silent machine. Each element performs a precise function. Together, they create the system we call the equity market.

Think of the market as a sophisticated engine. You see the exterior motion but rarely glimpse the gears turning inside. Beginners often chase price movements without understanding the structure that makes those movements possible. They miss the exchanges providing the platform. They overlook the companies offering actual ownership stakes. They ignore the regulators maintaining fairness or the settlement systems completing every transaction safely.

This article pulls back that curtain. We explore each of the eight foundational pieces that form Share Market Basics. No jargon. No complexity for its own sake. Just clear explanations using everyday language and relatable metaphors. Whether you plan to invest someday or simply want to understand how global markets function, grasping these components comes first. The machine only makes sense once you see how its parts connect.

Share Market Basics: Overview of Core Market Components

| Component | Core Function |

|---|---|

| Stock Exchange | Centralized platforms facilitating buying and selling of securities with regulated price discovery |

| Listed Companies | Businesses offering ownership shares to public investors through equity markets for capital expansion |

| Investors and Traders | Market participants providing liquidity and capital through buying and selling across timeframes |

| Brokers and Intermediaries | Licensed entities connecting participants to exchanges while managing compliance and execution |

| Regulators | Government authorities enforcing rules, monitoring disclosures, and protecting market integrity |

| Market Indices | Statistical measures tracking selected securities to reflect overall market or sector performance |

| Instruments | Financial products including equities, derivatives, and funds enabling different participation strategies |

| Clearing & Settlement System | Post-trade infrastructure ensuring accurate transfer of securities and funds between parties |

1. Share Market Basics: Understanding Stock Exchanges as the System’s Core Engine

Stock exchanges form the central engine where everything begins. Without them, Share Market Basics would collapse into chaos. These institutions provide the regulated space where buyers meet sellers. They establish pricing through transparent order matching. They maintain records of every transaction. They ensure liquidity so participants can enter and exit positions efficiently.

Major exchanges operate globally. The New York Stock Exchange handles trillions in trading volume annually. The Nasdaq powers technology-focused listings. The London Stock Exchange connects European capital. Tokyo Stock Exchange anchors Asian markets. Each functions like a massive digital marketplace running sophisticated matching algorithms.

The matching process happens in milliseconds. Buy orders stack on one side. Sell orders line up on the other side. When prices align, the exchange executes the trade automatically. This continuous matching creates price discovery. Market forces determine what each share costs at any given moment based on collective supply and demand.

Beyond execution, exchanges enforce listing requirements. Companies must meet financial standards before their shares trade publicly. They must maintain transparency through regular disclosures. Exchanges can delist firms that violate rules. This gatekeeping maintains credibility. Investors trust that listed companies have passed basic scrutiny.

Different exchanges specialize in different assets. Some focus on equities. Others handle derivatives or bonds. Some cater to large corporations while others support smaller growth companies. Technology transformed exchange operations. Physical trading floors with shouting brokers mostly disappeared. Electronic systems took over. Speed increased. Costs dropped. Access widened.

Share Market Basics: Functions and Features of Global Stock Exchanges

| Function | Description |

|---|---|

| Order Matching | Algorithmic systems pair buy and sell orders when price and quantity parameters align |

| Price Discovery | Continuous trading determines fair market value through real-time supply and demand |

| Liquidity Provision | High participation volumes enable quick position entry and exit without major disruption |

| Listing Standards | Minimum financial requirements ensure only qualified companies access public markets |

| Transaction Records | Complete audit trails document every trade for regulatory compliance and resolution |

| Market Hours | Defined trading sessions create structure with extended pre-market and after-hours opportunities |

| Surveillance Systems | Real-time monitoring detects unusual patterns, manipulation attempts, and violations |

| Circuit Breakers | Automatic trading pauses during extreme volatility protect against panic-driven crashes |

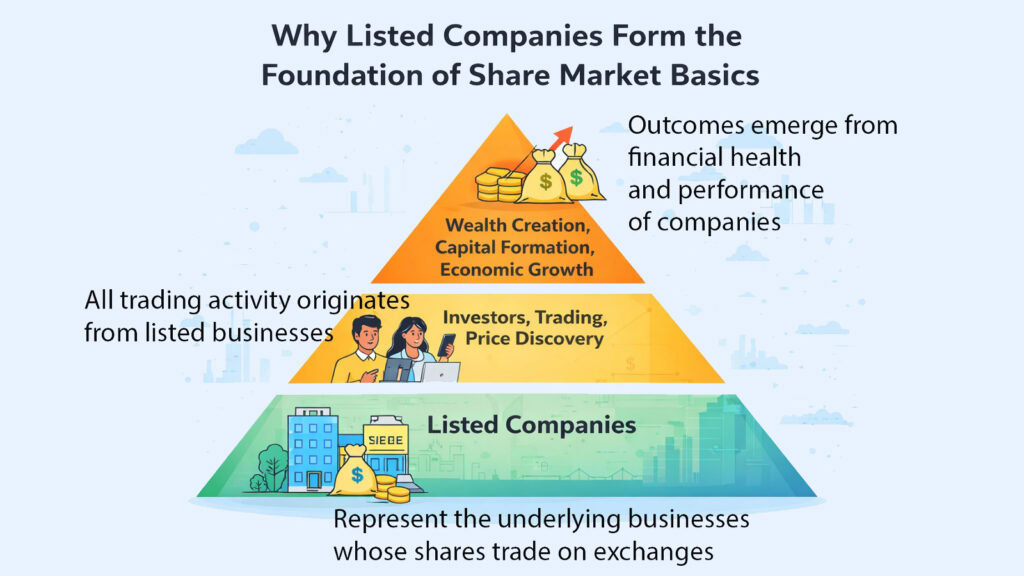

2. Share Market Basics: How Listed Companies Form the Market’s Foundation

Listed companies represent the actual products within the marketplace. Share Market Basics depend entirely on businesses willing to offer ownership stakes to public investors. Without companies listing their equity, no market exists. They form the foundation layer that makes everything else possible.

Companies choose public listing for clear reasons. Capital raising tops the list. Going public through an Initial Public Offering lets firms raise substantial funds by selling shares to investors. This capital fuels expansion, research, acquisitions, and operations. Visibility matters too. Listed status brings recognition. Media coverage increases. Brand awareness grows. Employees receive stock options tied to real market value.

The IPO process follows structured steps. Companies hire investment banks as underwriters. They prepare detailed prospectuses explaining business models, finances, risks, and plans. Regulators review these documents. Roadshows present opportunities to institutional investors. Finally, shares begin trading on an exchange.

Once listed, companies face ongoing obligations. They must release quarterly financial statements. Annual reports detail performance. Material events require immediate disclosure. Share Market Basics demand this transparency so investors can make informed decisions. Hiding problems or misleading stakeholders triggers regulatory action.

Companies span every sector and size. Technology giants trade alongside small biotech startups. Market capitalization measures company size. Multiply the share price by total shares outstanding. Large-cap companies exceed tens of billions. Mid-caps fall in between. Small-caps represent newer or niche businesses. Each category attracts different investor types with varying risk appetites.

Share Market Basics: Why Companies Choose Public Listing

| Aspect | Explanation |

|---|---|

| Capital Access | Public markets provide substantially larger funding sources than private arrangements |

| Growth Funding | IPO proceeds enable geographic expansion, product development, and infrastructure investment |

| Brand Enhancement | Listed status increases media visibility and perceived credibility among stakeholders |

| Employee Incentives | Stock option programs become meaningful when employees track real-time valuations |

| Founder Liquidity | Public trading allows early investors and founders to monetize ownership stakes |

| Acquisition Currency | Publicly traded shares can be used as payment for acquiring other companies |

| Analyst Coverage | Financial analysts provide research and ratings attracting institutional investor attention |

| Disclosure Requirements | Mandatory transparency builds investor confidence through regular financial reporting |

3. Share Market Basics: Why Investors and Traders Drive All Market Activity

Share Market Basics come alive through the people participating in them. Investors and traders form the lifeblood pumping through the system. Without their buying and selling activity, exchanges would sit empty. Listed companies would find no buyers for their shares. The entire machine would grind to a halt.

These participants are split into distinct categories. Long-term investors buy shares expecting to hold them for years. They focus on company fundamentals, dividend income, and gradual appreciation. Short-term traders operate differently. They seek quick profits from price movements lasting hours, days, or weeks. Technical patterns and momentum guide their decisions.

Retail investors are individuals using personal funds. They access markets through brokerage accounts. Institutional investors control far larger sums. Pension funds, mutual funds, insurance companies, and hedge funds deploy billions. Their trades move markets. A large institutional order can shift prices noticeably.

Domestic investors trade within their home country markets. Foreign investors cross borders seeking returns globally. This international flow affects currency markets and capital allocation worldwide. Share Market Basics increasingly reflect global interconnection as investors diversify beyond domestic options.

Risk tolerance also separates participants. Conservative investors prefer stable companies with steady dividends. Aggressive traders chase volatile stocks with dramatic swings. Behavioral patterns matter. Fear drives selling during downturns. Greed pushes buying during rallies. Understanding mass psychology helps explain why markets sometimes move irrationally.

Liquidity depends on participation volume. More active traders mean easier entry and exit. Share Market Basics thrive when diverse groups trade continuously, ensuring smooth price discovery and transaction completion. Market makers play special roles by always offering both buy and sell quotes, providing liquidity that keeps markets functioning efficiently.

Share Market Basics: Types and Characteristics of Market Participants

| Participant Type | Primary Characteristics |

|---|---|

| Long-Term Investors | Hold positions for years focusing on fundamental value and dividend income |

| Short-Term Traders | Execute frequent transactions capitalizing on momentum and technical patterns |

| Retail Investors | Individual participants using personal capital with varying account sizes |

| Institutional Investors | Organizations managing billions including pension funds and mutual funds |

| Domestic Investors | Participants trading primarily within home country markets with local currency |

| Foreign Investors | International capital seeking returns across borders creating global flow patterns |

| Conservative Investors | Risk-averse participants preferring stable companies with consistent dividends |

| Aggressive Traders | Risk-seeking participants targeting volatile stocks with potential for dramatic moves |

4. Share Market Basics: The Role of Brokers and Intermediaries as Vital Connectors

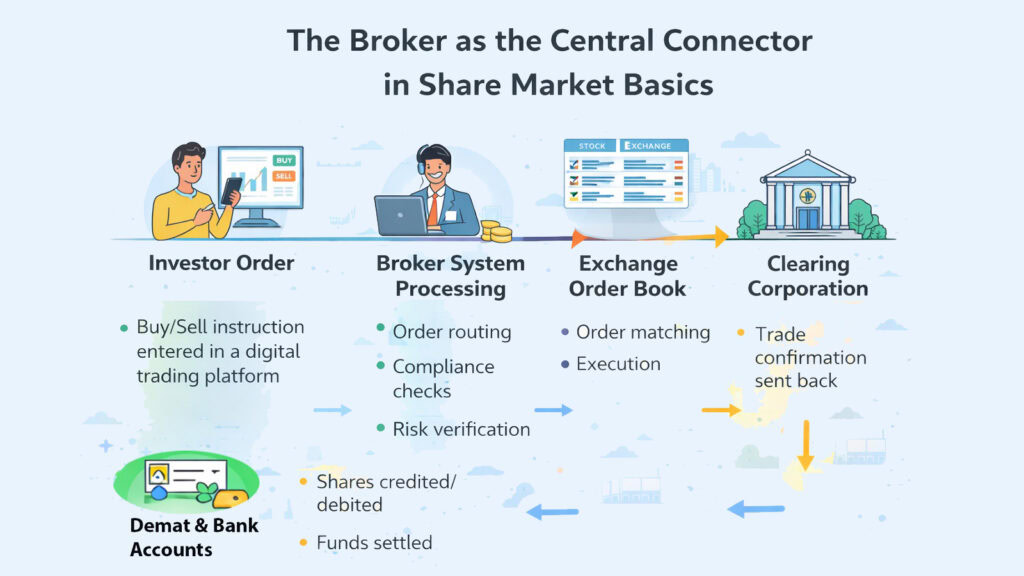

Brokers serve as essential bridges within Share Market Basics. Individual investors cannot directly access exchange systems. Regulations require licensed intermediaries to handle order placement, execution, and custody. Brokers fill this role. They connect millions of participants to centralized trading venues while managing compliance and technical infrastructure.

When you decide to buy shares, you log into your brokerage platform. You enter the ticker symbol, quantity, and order type. That instruction travels from your device through the broker’s systems to the exchange. Within milliseconds, the order enters electronic order books. If matching conditions exist, execution happens automatically. Confirmation returns through the same chain.

Behind this simple interface lies substantial complexity. Brokers maintain relationships with exchanges and clearing corporations. They handle regulatory paperwork. They verify customer identity through know-your-customer protocols. They monitor accounts for suspicious activity. They provide margin lending for qualified clients. They generate tax documents.

Demat accounts revolutionized Share Market Basics. Previously, physical share certificates changed hands. This created risks of loss, theft, and forgery. Electronic holdings solved these problems. Now, brokers maintain demat accounts storing shares digitally. Transfers happen through computer entries rather than paper exchanges.

Full-service brokers offer research, advice, and portfolio management. They charge higher fees but provide personalized guidance. Discount brokers focus on execution only. Their fees drop substantially. Online platforms further reduced costs while expanding access. Commission rates fell from substantial percentages to nearly zero in many markets.

Regulatory oversight governs broker operations strictly. Licenses require financial minimums and compliance systems. Client funds must remain segregated from broker capital. Insurance schemes protect investors if brokers fail. Technology transformed brokerage. Mobile apps replaced phone calls. Real-time quotes became standard. The barrier between professional and retail trading tools largely disappeared.

Share Market Basics: Functions and Services of Brokerage Firms

| Function | Description |

|---|---|

| Order Execution | Transmit buy and sell instructions from clients to exchanges ensuring accurate completion |

| Demat Account Management | Maintain electronic holdings of securities eliminating physical certificates and risks |

| Regulatory Compliance | Verify customer identities, monitor suspicious activities, and submit required reports |

| Margin Lending | Provide leverage to qualified clients enabling larger positions than cash would support |

| Research and Analysis | Full-service firms offer market insights, stock recommendations, and portfolio guidance |

| Tax Documentation | Generate annual statements summarizing transactions, dividends, and capital gains |

| Platform Technology | Develop trading interfaces including desktop software, web portals, and mobile apps |

| Customer Support | Assist clients with technical issues, account questions, and transaction clarifications |

5. Share Market Basics: Regulators as the Market’s Protective Framework

Regulators form the protective shell surrounding Share Market Basics. Without oversight, markets would devolve into fraud and manipulation. Rules create fairness. Enforcement builds trust. Monitoring catches violations. Penalties deter misconduct. This framework allows participants to engage confidently, knowing authorities watch for abuse.

Different countries maintain different regulatory bodies. The Securities and Exchange Commission governs American markets. The Securities and Exchange Board of India oversees Indian exchanges. Japan’s Financial Services Agency handles regulatory duties there. China operates through the China Securities Regulatory Commission. Despite different names and structures, their core mission stays consistent across borders.

Regulators approve new securities before public offering. Companies must file detailed disclosures. These documents face scrutiny. Misleading statements get rejected. Only after approval can shares begin trading. This gatekeeping prevents obviously fraudulent offerings from reaching investors.

Ongoing monitoring continues post-listing. Regulators require quarterly and annual financial statements. They track insider transactions. Corporate officers must report their trades. Large shareholders face disclosure thresholds. These rules shine a light on actions that could signal problems.

Insider trading enforcement protects market fairness. Trading on non-public material information creates unfair advantages. Share Market Basics depend on level playing fields where all participants have access to the same facts. Regulators investigate suspicious trading patterns and prosecute violations aggressively.

Market manipulation takes various forms. Pump-and-dump schemes artificially inflate prices. Spoofing involves fake orders that get canceled. Regulators combat these tactics through surveillance systems and enforcement actions. Fines reach millions. Criminal charges bring prison time.

Investor protection schemes provide safety nets. When brokers fail, insurance funds compensate affected clients up to defined limits. Rules evolve as markets change. Regulators adapt frameworks addressing novel situations while maintaining core principles of transparency and fairness.

Share Market Basics: Regulatory Functions Across Global Markets

| Function | Purpose |

|---|---|

| IPO Approval | Review and authorize new securities offerings ensuring adequate disclosure and compliance |

| Financial Disclosure | Require regular reporting of company performance allowing informed investor decisions |

| Insider Trading Prevention | Monitor and prosecute illegal trading on non-public information maintaining fair access |

| Market Manipulation Detection | Identify and eliminate schemes like pump-and-dump and spoofing distorting natural pricing |

| Broker Oversight | License and audit intermediaries ensuring financial stability and client protection measures |

| Investor Protection Programs | Administer insurance schemes compensating clients when licensed firms fail or commit fraud |

| Corporate Governance Standards | Establish minimum requirements for board independence and shareholder rights |

| Enforcement Actions | Investigate violations, levy fines, suspend licenses, and pursue criminal charges |

6. Share Market Basics: Market Indices as the Market’s Real-Time Pulse

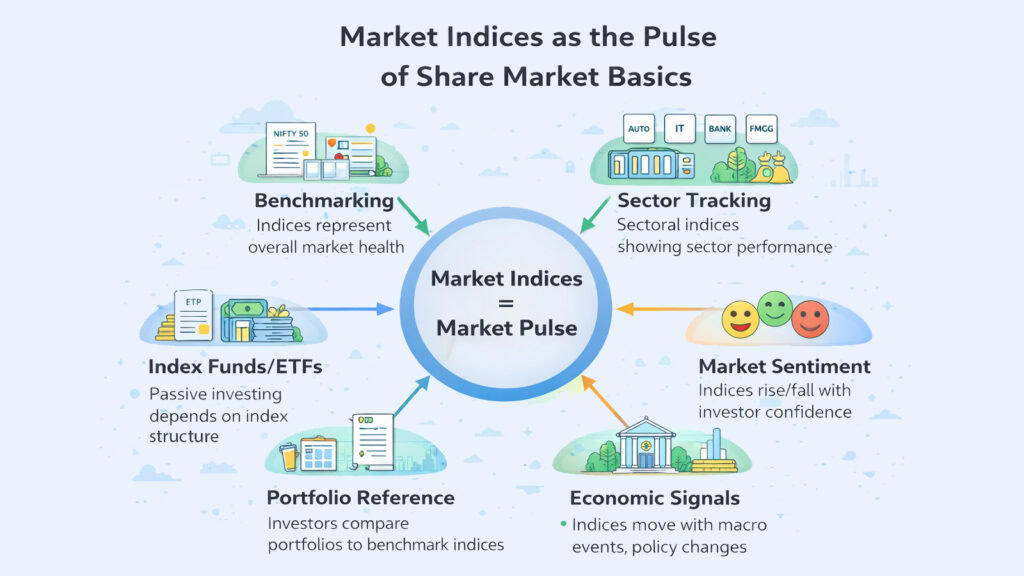

Market indices serve as the pulse reading of Share Market Basics. These statistical measures track selected groups of stocks to reflect broader market performance. Rather than monitoring thousands of individual companies, investors watch indices for quick snapshots of overall conditions. They simplify complexity into single numbers that rise and fall with collective sentiment.

Construction methodologies vary. Some indices include every listed company on an exchange. Others select specific quantities based on defined criteria. Market capitalization often determines inclusion. Larger companies receive a heavier weighting. Their price movements affect the index more than smaller constituents.

The Dow Jones Industrial Average tracks thirty major American corporations. The S&P 500 captures five hundred large-cap companies representing roughly eighty percent of American market capitalization. Nasdaq Composite focuses on technology-heavy listings. Each tells a different story about market segments.

Internationally, indices anchor their respective regions. London’s FTSE 100 tracks the top British companies. Germany’s DAX measures major German corporations. Japan’s Nikkei 225 represents Tokyo Stock Exchange leaders. Hong Kong’s Hang Seng captures major Chinese and regional firms. India’s Sensex follows thirty prominent Bombay Stock Exchange listings.

Sector indices narrow focus further. Technology indices track only tech companies. Financial indices follow banks and insurance firms. This granularity helps investors understand which industries drive broader movements. When technology outperforms, tech-heavy indices rise faster than diversified ones.

Index movements signal market sentiment. Rising indices suggest optimism. Declining indices reflect pessimism. Volatility indicates uncertainty. Share Market Basics teaches that indices don’t predict futures, but they do capture the present mood. Investment products tie directly to indices. Index funds hold every constituent in proportion matching the index. ETFs trade like stocks while tracking indices.

Share Market Basics: Major Global Indices and Their Composition

| Index | Description |

|---|---|

| Dow Jones Industrial Average | Tracks 30 large American corporations across industries using price-weighted methodology |

| S&P 500 | Captures 500 large-cap U.S. companies representing approximately 80% of market capitalization |

| Nasdaq Composite | Includes over 3,000 stocks listed on Nasdaq exchange with heavy technology concentration |

| FTSE 100 | Measures 100 largest companies by market cap on London Stock Exchange |

| DAX | Tracks 40 major German companies listed on Frankfurt Stock Exchange |

| Nikkei 225 | Represents 225 large Japanese companies selected across Tokyo Stock Exchange sectors |

| Hang Seng | Captures major Hong Kong-listed companies including Chinese firms providing regional indicator |

| Sensex | Follows 30 established companies on Bombay Stock Exchange reflecting Indian market |

7. Share Market Basics: Financial Instruments That Shape Market Participation

Financial instruments within Share Market Basics offer different ways to participate in markets. Each instrument carries distinct characteristics affecting risk, return, ownership, and strategy. Understanding these options helps participants choose approaches matching their goals and constraints.

Equities represent ownership stakes. When you purchase common stock, you acquire a fractional ownership stake. You gain voting rights in shareholder meetings. You receive dividends if the company distributes profits. Your shares appreciate if the company succeeds or depreciate if it struggles. This combination attracts growth-focused investors willing to accept volatility.

Derivatives get their value from underlying assets. Futures contracts obligate buying or selling at predetermined prices on future dates. Options give rights without obligations to transact at specific prices. These instruments enable hedging and speculation. Leverage amplifies both gains and losses, making derivatives riskier than direct equity ownership.

Exchange-traded funds bundle multiple securities into single tradeable units. Equity ETFs might hold all stocks in an index. Bond ETFs aggregate fixed-income securities. Investors gain instant diversification through one transaction. Fees typically stay low compared to actively managed mutual funds.

Real Estate Investment Trusts own income-generating properties. REITs must distribute most earnings as dividends. Investors gain real estate exposure without managing physical buildings. Bonds represent loans to issuers. Corporations and governments sell bonds, raising capital while committing to interest payments and principal repayment. Returns usually stay steadier than stocks, though growth potential remains limited.

Preferred shares blend equity and debt characteristics. They pay fixed dividends like bonds but trade on exchanges like common stock. Mutual funds pool investor capital under professional management. Fund managers select holdings trying to beat benchmarks. Both provide diversification and professional oversight within Share Market Basics.

Share Market Basics: Common Financial Instruments and Their Characteristics

| Instrument | Key Features |

|---|---|

| Common Equities | Ownership shares providing voting rights, dividend eligibility, and appreciation potential |

| Derivatives | Contracts deriving value from underlying assets enabling hedging and speculation with leverage |

| Exchange-Traded Funds | Baskets of securities trading like stocks providing instant diversification with low fees |

| Real Estate Investment Trusts | Property-owning entities distributing rental income as dividends offering real estate exposure |

| Corporate Bonds | Debt securities paying fixed interest with repayment obligations ranking above equity |

| Government Bonds | Sovereign debt instruments offering lower risk and returns backed by taxation power |

| Preferred Shares | Hybrid securities paying fixed dividends with priority over common stock |

| Mutual Funds | Professionally managed investment pools offering diversification through active or passive strategies |

8. Share Market Basics: The Clearing & Settlement System Behind Every Trade

Clearing and settlement complete the Share Market Basics cycle. When trades execute on exchanges, the visible part finishes quickly. But behind those instant confirmations, complex systems verify details, transfer ownership, and move funds. This post-trade infrastructure ensures accuracy and security. Without it, markets would collapse into disputes and failures.

Clearing happens first. Clearinghouses act as intermediaries between buyers and sellers. They verify that both parties have sufficient securities or funds to complete transactions. They calculate net obligations when participants trade multiple times daily. Rather than settling each trade individually, netting combines positions. This efficiency reduces transaction costs and operational burden.

Risk management permeates clearing. Margin requirements ensure participants can cover potential losses. Clearinghouses monitor positions continuously. If losses accumulate, they demand additional collateral. This oversight prevents individual failures from cascading through markets.

Settlement transfers actual ownership. In most major markets, this follows T+1 cycles. Trades executing today settle one business day later. During that period, clearinghouses guarantee completion even if one party defaults. On the settlement date, securities move from seller accounts to buyer accounts electronically through demat systems. Simultaneously, payment flows opposite direction.

Central depositories store securities electronically. These institutions maintain master records of ownership. When shares change hands, depositories update their databases. No physical certificates move. This digital system eliminated risks of loss, theft, and forgery that plagued earlier paper-based settlements.

Payment systems coordinate with securities transfers. Designated settlement banks handle fund movements. Timing synchronization ensures delivery-versus-payment. Neither party faces risk of delivering securities without receiving payment or vice versa. Settlement speed matters. Shorter cycles reduce risk exposure. Markets moved from T+3 to T+2 and recently to T+1 in some jurisdictions.

Share Market Basics: Clearing and Settlement Process Components

| Component | Function |

|---|---|

| Trade Verification | Confirm both parties agree on transaction details including security, quantity, and price |

| Netting Calculations | Combine multiple trades for each participant determining net securities and payment obligations |

| Risk Management | Monitor positions and margin requirements protecting system from participant defaults |

| Central Depositories | Maintain electronic records of securities ownership enabling transfers without physical certificates |

| Clearinghouses | Act as intermediaries guaranteeing trade completion and managing counterparty risk |

| Settlement Banks | Handle payment transfers coordinating fund movements synchronized with securities delivery |

| Delivery-Versus-Payment | Ensure simultaneous exchange of securities and funds eliminating one-sided delivery risk |

| T+1 Settlement Cycle | Standard timeline where trades executing today complete settlement one business day later |

Conclusion: Share Market Basics – Market’s 8-Part Silent Machine

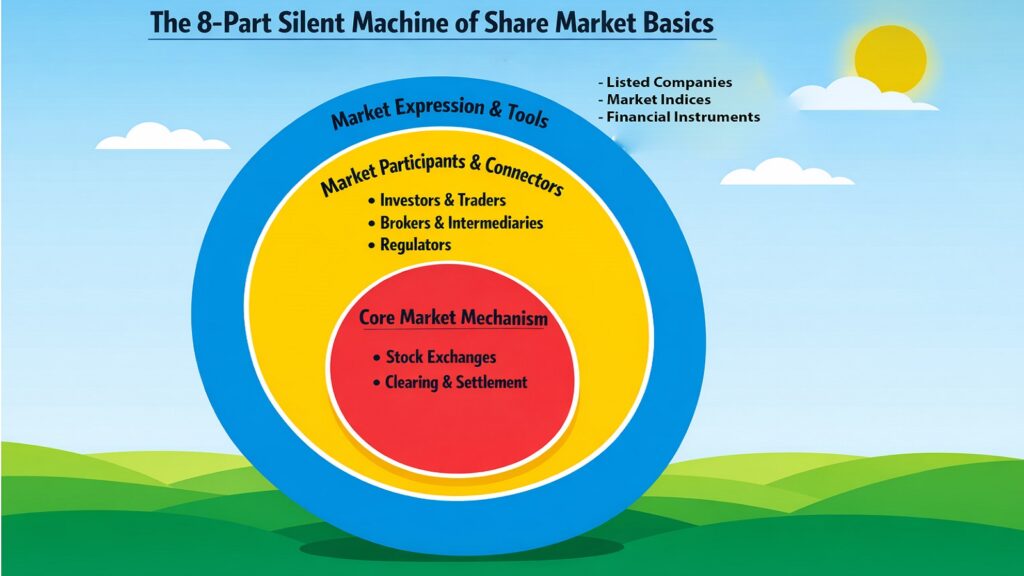

Share Market Basics reveal a sophisticated machine operating beneath visible price movements. Eight components fit together, creating the structure that enables global equity markets. Stock exchanges provide the central engine where trading happens. Listed companies offer the actual products that participants buy and sell. Investors and traders supply the liquidity, making markets function. Brokers bridge individuals to exchanges while managing compliance. Regulators maintain fairness through oversight and enforcement. Market indices deliver real-time performance snapshots. Financial instruments provide diverse participation methods. Clearing and settlement systems complete transactions accurately and securely.

Each part serves a specific purpose. Remove any component, and the system breaks down. Exchanges without listed companies have nothing to trade. Companies without investors find no buyers. Investors without brokers cannot access markets. Markets without regulators lose credibility. The interdependence runs deep throughout Share Market Basics.

Understanding this architecture matters before investing money or time. Too many beginners chase hot tips without grasping the underlying structure. They see prices moving but miss the mechanisms creating those movements. This knowledge gap leads to poor decisions and unrealistic expectations.

The machine runs globally now. Markets in New York, London, Tokyo, Mumbai, and Shanghai all follow similar architectural principles despite local variations. Capital flows across borders instantly. Technology accelerated integration. What started as local exchanges evolved into an interconnected global infrastructure.

Market complexity continues to grow. New instruments emerge. Regulatory frameworks adapt. Technology advances. But the core eight components of Share Market Basics remain constant. This foundation supports trillions in daily trading volume. Millions of participants engage continuously. The silent machine rarely stops. It processes countless transactions while most people sleep, work, and live their lives unaware.

Further learning awaits. Each component offers deeper topics worth exploring. Share Market Basics provide the starting point. Where you go next depends on your interests and goals. The market rewards understanding. Knowledge reduces risk. It improves decision quality. It builds confidence. Master these eight components. Then venture into specialized topics equipped with solid structural knowledge.

Share Market Basics: Impact and Interconnection of Market Components

| Component | System Impact |

|---|---|

| Stock Exchanges | Without regulated trading venues, price discovery would fail and liquidity would disappear |

| Listed Companies | Markets cannot exist without businesses offering ownership stakes creating underlying value |

| Investors and Traders | Participation provides the capital flow and liquidity enabling all market transactions |

| Brokers and Intermediaries | Individual access depends on intermediaries bridging retail participants to infrastructure |

| Regulators | Fair rules and enforcement build the trust necessary for participants to risk capital |

| Market Indices | Benchmarks simplify complex information enabling quick assessment of market conditions |

| Instruments | Diverse products allow participants to match strategies with risk tolerance and objectives |

| Clearing & Settlement | Post-trade systems complete transactions accurately preventing disputes and ensuring delivery |

Read More Business and Economy Articles

- Geopolitics in Global Economy: 6 Powerful Strategic Moves

- Global South Economies: 6 Powerful Forces Driving World Growth

- AI Job Growth: 6 Powerful Trends Fueling a Brighter Future

- AI Job Losses: 6 Devastating Impacts You Can’t Ignore

- 6 Powerful Ways Brand Management Wins Consumer Loyalty

- 6 Powerful Consumer Insights That Drive Global Brands

- Sovereign Debt: 6 Alarming Risks Wealthy Nations Ignore

- Business 360° Breakthrough: Unlock Powerful Growth Today

- Indian Economy: Defying History to Become a Top Economy

- 10 Most Important Business Functions For An Organization

Disclaimer: This article is intended solely for informational and educational purposes. It explains the basics of the Share Market and the structural components of the share market in a general, non-technical manner. The content does not constitute trading advice, investment advice, financial advice, or a recommendation to buy or sell any securities or financial instruments. Readers should not interpret any part of this article as guidance for making trading or investment decisions. Always consult a qualified financial advisor or conduct independent research before making any financial or investment-related decisions.