Table of Contents

Introduction: Global Trade and Its Powerful Role in Geopolitics

Beneath the surface of every cargo ship crossing the Pacific and every oil tanker navigating the Strait of Hormuz lies a complex web of power, influence, and strategic calculation. Global trade encompasses much more than merely the straightforward transfer of products and services between nations. It stands as the invisible architecture of modern geopolitics and global economy, shaping alliances, creating dependencies, and determining which nations rise or fall in the international order.

As global trade is projected to approach $33 trillion in 2024, with a growth rate of 4% after a period of uncertainty, it is crucial for individuals aiming to interpret the dynamics of nations on the international stage to comprehend these commercial flows. Every trade route secured, every supply chain controlled, and every tariff imposed carries implications that ripple through diplomatic corridors and military planning rooms worldwide.

Global trade functions as one of the most critical building blocks of the global economy and globalization, interacting with financial systems, technological innovation, and geopolitical structures in ways that reshape the balance of power. The following analysis explores how global trade relationships drive political outcomes, creating a world where economic interdependence and strategic competition exist in constant tension.

Table 1: Global Trade and Its Interconnections with Building Blocks of The Global Economy

| Components Of Global Economy | Relationship with Global Trade | Impact on Geopolitics |

|---|---|---|

| Financial Systems and Capital Flow | Trade financing, currency exchange, and investment flows support commercial transactions | Creates monetary dependencies and influences exchange rate policies |

| Labor and Migration | Worker movement follows trade patterns; skilled labor supports export industries | Shapes immigration policies and bilateral labor agreements |

| Technology and Innovation | Technology transfer through trade accelerates development; digital platforms enable services trade | Drives technology competition and intellectual property disputes |

| Natural Resources and Energy | Resource exports create trade dependencies; energy security depends on import relationships | Forms basis for resource diplomacy and energy alliances |

| Governance and Institutions | International trade rules require institutional frameworks; WTO and regional bodies govern commerce | Establishes legal frameworks that influence sovereignty and policy autonomy |

| Global Supply Chain | Manufacturing networks span continents; just-in-time production requires seamless trade flows | Creates strategic vulnerabilities and drives supply chain security policies |

| Geopolitics | Trade relationships influence diplomatic alignments; economic partnerships support political alliances | Direct feedback loop where commerce shapes politics and vice versa |

| Demographics | Population growth drives consumption patterns; aging societies affect trade balances | Influences long-term trade strategies and resource allocation |

| Climate and Sustainability | Environmental regulations affect trade costs; green technology exports create new markets | Drives climate diplomacy and sustainable development partnerships |

1. Global Trade and Strategic Control of Trade Routes

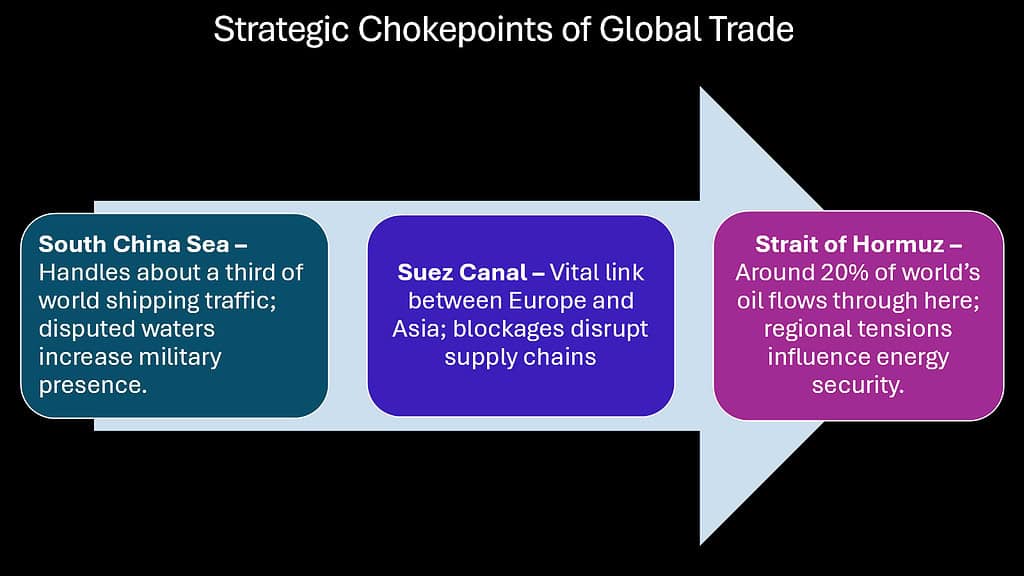

The world’s most critical shipping lanes function as modern-day battlegrounds where economic interests and national security converge. Control over these maritime highways grants nations extraordinary leverage over global trade, transforming geography into geopolitical power.

The Suez Canal alone handles approximately 12% of global maritime trade, making it a pressure point that can send shockwaves through the world economy when disrupted. Recent attacks on shipping in the Red Sea demonstrated how quickly trade flows can be weaponized, forcing over 470 container vessels to seek alternative routes around Africa, adding weeks and billions of dollars to shipping costs.

The South China Sea poses an increasingly intricate challenge, acting as a crucial channel for the globe’s largest economies. China’s firm assertions regarding these waters indicate a recognition that dominance over sea routes equates to dominance over the economic lifelines of rival nations. Significant trade pathways traversing the South China Sea link essential economies like Japan, South Korea, and China, all of which rely on maritime commerce for their growth, thereby establishing a strategic landscape where commercial interests and military displays converge.

Meanwhile, the Strait of Hormuz remains the world’s most critical energy chokepoint, with roughly 21% of global petroleum liquids passing through its narrow waters. Various conflicts around this passage serve as a reminder that geography can be weaponized, turning global trade routes into instruments of foreign policy.

Table 2: Critical Maritime Chokepoints and Their Strategic Significance

| Chokepoint | Trade Volume | Strategic Importance | Controlling Powers | Geopolitical Risks |

|---|---|---|---|---|

| Strait of Hormuz | 21% of global petroleum liquids | Critical energy supply route | Iran, UAE, Oman | Iranian closure threats, regional conflicts |

| Suez Canal | 12% of global maritime trade | Asia-Europe commercial lifeline | Egypt | Regional instability, terrorist attacks |

| Strait of Malacca | 25% of traded goods | Asia-Pacific commercial hub | Malaysia, Singapore, Indonesia | Piracy, territorial disputes |

| South China Sea | $3.4 trillion annual trade | Critical for East Asian economies | China (disputed claims) | Military tensions, territorial conflicts |

| Panama Canal | 14,000+ annual transits | Americas trade connector | Panama | Climate impacts, capacity constraints |

| Strait of Gibraltar | 20% of Mediterranean traffic | Europe-Africa gateway | Spain, Morocco | Migration issues, regional tensions |

2. Global Trade and National Economic Dependencies

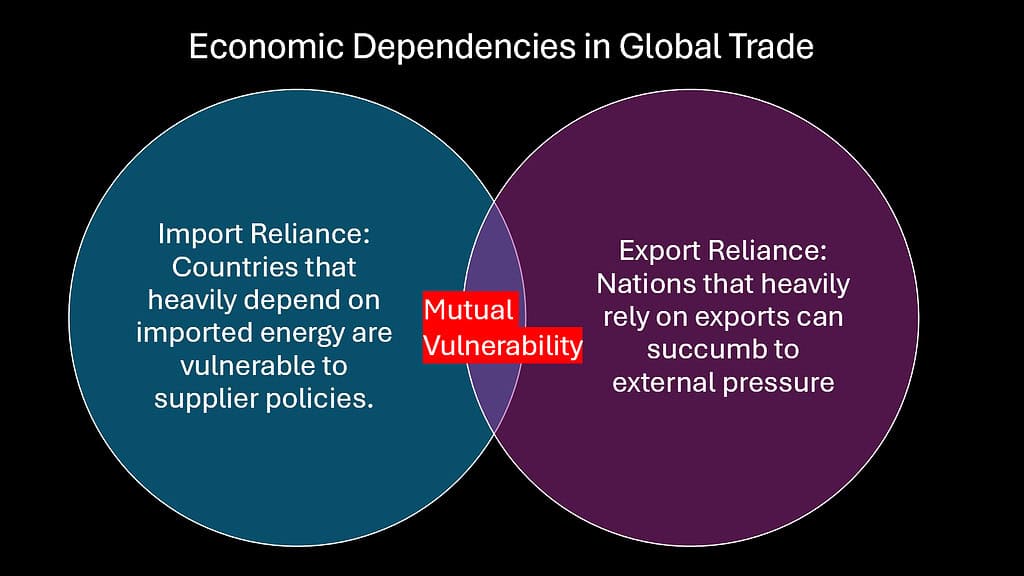

Economic interdependence through trade creates invisible chains that bind nations together while simultaneously providing leverage for political influence. Countries that become overly reliant on specific imports or export markets often find their foreign policy options constrained by commercial considerations.

Germany’s dependence on Russian natural gas exemplified how trade relationships can become strategic vulnerabilities. For decades, cheap Russian energy powered German industry while Moscow gained significant influence over European policy decisions. The 2022 conflict in Ukraine forced Germany to rapidly restructure its energy imports, demonstrating the painful costs of unwinding deeply embedded trade dependencies.

Similarly, China’s dominance in rare earth mineral production and processing has created global dependencies that extend far beyond commercial relationships. Nations seeking to develop renewable energy technologies or advanced manufacturing capabilities must navigate Chinese supply chains, giving Beijing considerable leverage in international negotiations.

The United States faces its own dependencies, particularly in manufacturing sectors that migrated overseas during decades of globalization. The COVID-19 pandemic revealed how reliance on foreign suppliers for critical medical equipment and pharmaceuticals could compromise national security during emergencies.

Table 3: Major Trade Dependencies and Their Political Implications

| Country/Region | Critical Import Dependency | Source | Political Leverage Created |

|---|---|---|---|

| Germany | Natural gas (pre-2022) | Russia | Russian influence over European energy policy |

| European Union | Rare earth minerals | China (90% market share) | Chinese leverage in tech and defense sectors |

| United States | Pharmaceuticals | China, India | Vulnerability in healthcare supply chains |

| Japan | Energy imports | Middle East, Australia | Diplomatic constraints in regional conflicts |

| China | Agricultural products | United States, Brazil | Food security concerns affecting trade policy |

| South Korea | Energy and raw materials | Multiple sources | Need for diplomatic balancing |

3. Global Trade as a Weapon: Tariffs, Sanctions, and Barriers

Modern nations have transformed traditional trade tools into sophisticated weapons of statecraft, using tariffs, sanctions, and regulatory barriers to achieve political objectives without resorting to military force. This economic warfare has become a preferred method of international coercion, offering plausible deniability while inflicting real economic damage.

The United States has pioneered the use of secondary sanctions, threatening to cut off any company that does business with targeted nations from the American financial system. This approach has proven devastatingly effective, as evidenced by the isolation of Iranian banks and the disruption of Russian trade networks following the Russia-Ukraine conflict.

China has developed its own arsenal of trade weapons, including rare earth export restrictions and targeted boycotts of foreign companies. Beijing’s economic retaliation against countries that challenge its policies has become a predictable pattern, from restricting Norwegian salmon imports during diplomatic disputes to limiting Australian coal purchases amid political tensions.

Trade wars have evolved beyond simple tariff escalation to include sophisticated regulatory barriers, technology transfer requirements, and investment restrictions. The ongoing technology competition between the United States and China demonstrates how trade policy has become inseparable from national security strategy.

Table 4: Recent Examples of Trade Weaponization

| Implementing Country | Target | Tool Used | Political Objective | Economic Impact |

|---|---|---|---|---|

| United States | China | Technology export controls | Limit military modernization | $150+ billion in affected trade |

| China | Australia | Coal, wine import restrictions | Punish political criticism | $20 billion in lost exports |

| Russia | European Union | Natural gas supply cuts | Counter Western sanctions | Energy crisis, inflation spike |

| European Union | Russia | Swift banking exclusions | Isolate Russian economy | $300+ billion in frozen assets |

| United States | Iran | Oil export sanctions | Limit nuclear program funding | 80% reduction in oil exports |

| China | South Korea | Tourism restrictions | Protest THAAD deployment | $15 billion tourism losses |

4. Global Trade and Resource-Driven Alliances

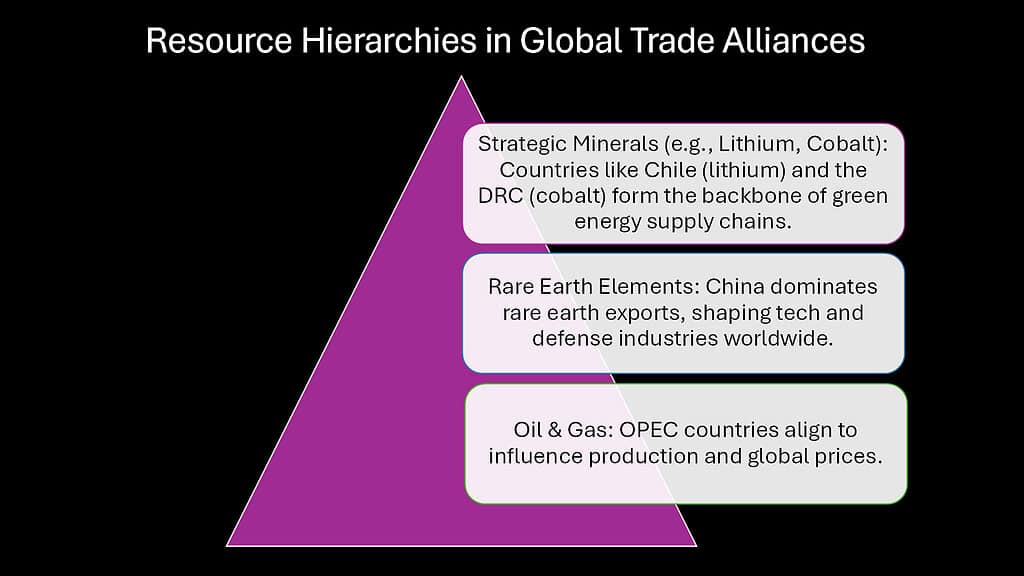

The global distribution of natural resources creates enduring patterns of alliance and rivalry that transcend traditional diplomatic relationships. Nations rich in critical resources wield influence far beyond their military or economic power, while resource-dependent countries must carefully navigate relationships with suppliers who may also be strategic competitors.

The connection between Saudi Arabia and the United States serves as an example of how resource diplomacy influences global trade and geopolitical alliances. Despite significant differences in various policies, America’s historical dependence on Saudi oil maintained a strategic partnership that influenced Middle Eastern politics for decades.

China has systematically built resource-based alliances across Africa, Latin America, and Central Asia through its Belt and Road Initiative. By providing infrastructure financing in exchange for long-term resource supply agreements, Beijing has created a network of economically dependent partners that provide both raw materials and diplomatic support.

The energy transition has created new resource dependencies, with lithium, cobalt, and rare earth minerals becoming the oil of the 21st century. Countries controlling these resources, from Chile to the Democratic Republic of Congo, suddenly find themselves courted by major powers seeking to secure supply chains for renewable energy technologies.

Table 5: Resource-Based Strategic Relationships

| Resource | Major Suppliers | Key Importers | Geopolitical Implications |

|---|---|---|---|

| Lithium | Chile, Australia, Argentina | China, United States, Europe | Competition for battery supply chains |

| Rare Earth Minerals | China (85% production) | Global tech manufacturers | Chinese leverage over technology sectors |

| Natural Gas | Russia, United States, Qatar | Europe, Asia | Energy security driving alliance patterns |

| Cobalt | Democratic Republic of Congo | Global battery manufacturers | African strategic importance increases |

| Petroleum | Saudi Arabia, Russia, United States | Global economy | Continued influence over global pricing |

| Critical Minerals | Various developing nations | Developed economies | New resource diplomacy emerging |

5. Global Trade in Services and Soft Power Influence

The expansion of services trade has created new avenues for nations to project soft power and cultural influence across borders. From Hollywood movies to Silicon Valley platforms, the export of cultural products and digital services has become a crucial component of international influence that extends far beyond traditional economic metrics.

The United States maintains global dominance in financial services, with American banks, credit card companies, and investment firms facilitating international transactions worldwide. This financial infrastructure provides Washington with unprecedented visibility into global economic flows and the ability to enforce sanctions through dollar-denominated transactions.

China has emerged as a major exporter of digital services and entertainment content, with platforms like TikTok reaching billions of users globally. This digital expansion represents a new form of cultural diplomacy, allowing Beijing to shape global conversations and gather valuable data on foreign populations.

The European Union has leveraged its regulatory power to influence global digital standards through instruments like the General Data Protection Regulation. By controlling access to the massive European market, Brussels can effectively set global standards for data privacy and digital commerce.

Table 6: Services Trade and Soft Power Influence

| Country/Region | Service Sector | Global Market Share | Soft Power Impact |

|---|---|---|---|

| United States | Financial services | 40% of global transactions | Dollar dominance, sanctions capability |

| United States | Entertainment content | 70% of global box office | Cultural influence, narrative control |

| China | Digital platforms | 1+ billion global users | Data collection, cultural influence |

| European Union | Digital regulations | Global standard setter | Regulatory influence, privacy norms |

| India | Information technology | 55% of global outsourcing | Technical expertise recognition |

| South Korea | Cultural content | $12 billion in exports | Cultural diplomacy, brand enhancement |

6. Global Trade, Trade Balances, and Rivalries Among Nations

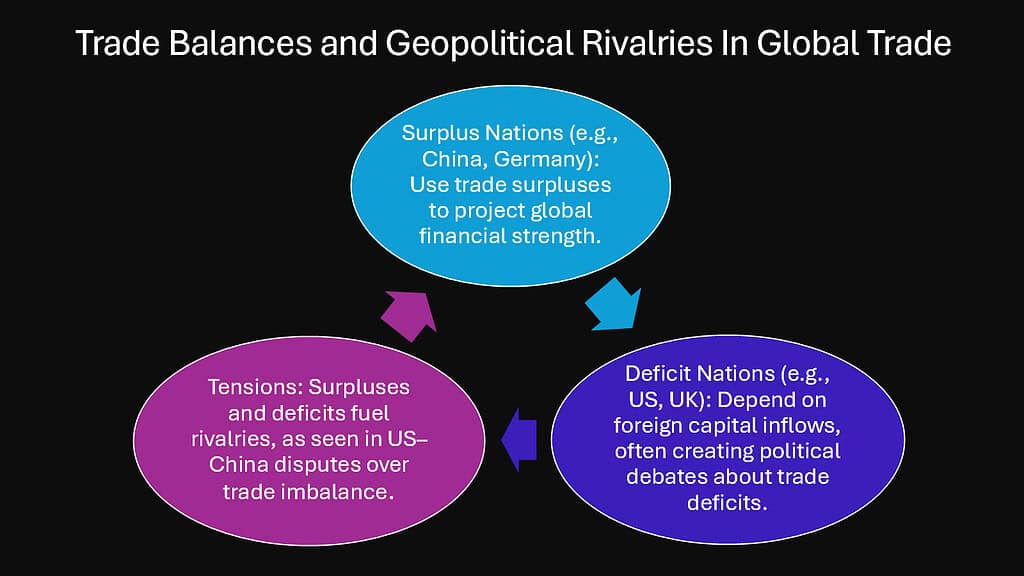

Trade surpluses and deficits act as clear indicators of economic rivalry among countries, shaping domestic political discourse, global relations, and global trade. Persistent imbalances create tensions that can escalate into full-scale trade wars, as countries seek to protect domestic industries and maintain favorable economic positions.

The massive trade surplus that China has maintained with the United States became a central issue in American politics, contributing to the rise of protectionist sentiment and the escalation of trade tensions during the Trump administration. Chinese surpluses, which peaked at over $400 billion annually, were portrayed as evidence of unfair trade practices and became justification for punitive tariffs.

Germany’s persistent trade surpluses within the European Union have created similar tensions, with Southern European countries arguing that German competitive advantages undermine their economic recovery prospects. These imbalances have complicated European integration efforts and contributed to political tensions within the EU.

Trade deficits can also reflect underlying economic strengths, as countries with strong domestic consumption attract imports from around the world. The American trade deficit partly reflects the dollar’s role as the global reserve currency and the attractiveness of American markets to foreign exporters.

Table 7: Major Trade Imbalances In Global Trade and Their Political Consequences

| Trade Relationship | Annual Balance (2023) | Political Impact | Policy Response |

|---|---|---|---|

| US-China | $382 billion deficit | Anti-China sentiment | Tariffs, technology controls |

| Germany-EU partners | $280 billion surplus | European tensions | Pressure for rebalancing |

| Japan-Asia | $45 billion surplus | Regional competition | Investment promotion |

| Russia-Europe (pre-2022) | $140 billion surplus | Energy dependence | Diversification efforts |

| Saudi Arabia-Global | $150 billion surplus | Petrodollar influence | Sovereign wealth accumulation |

| South Korea-Global | $25 billion surplus | Export-led growth model | Domestic consumption promotion |

7. Global Trade and the Power of Supply Chain Dominance

Control over critical supply chains has emerged as perhaps the most important form of economic power in the 21st century. Nations that dominate key manufacturing processes or control bottleneck technologies can effectively hold entire global trade hostage, using supply chain leverage to achieve political objectives.

Taiwan’s position in the global semiconductor supply chain illustrates how small territories can wield enormous influence through technological specialization. The island is responsible for producing more than 90% of the globe’s most sophisticated microchips, rendering it essential for a wide range of applications, including smartphones and military systems. This dominance has become both Taiwan’s greatest strategic asset and its most significant vulnerability.

China’s control over pharmaceutical ingredient manufacturing became apparent during the COVID-19 pandemic, when supply shortages raised questions about the national security implications of offshored production. Similarly, Chinese dominance in solar panel manufacturing has created dilemmas for countries seeking energy independence while pursuing renewable energy goals.

The fragility of just-in-time supply chains was exposed by the Ever Given container ship blocking the Suez Canal in 2021, demonstrating how single points of failure can disrupt global trade. This vulnerability has prompted nations to rethink supply chain resilience and consider reshoring critical production capabilities.

Table 8: Critical Supply Chain Chokepoints In Global Trade and Their Strategic Implications

| Supply Chain Segment | Dominant Controller | Global Market Share | Strategic Vulnerability |

|---|---|---|---|

| Advanced semiconductors | Taiwan (TSMC) | 92% of cutting-edge chips | Technology dependence, military implications |

| Rare earth processing | China | 85% of global processing | Green technology supply chains |

| Pharmaceutical ingredients | China, India | 80% of API production | Healthcare system vulnerability |

| Battery materials | China | 75% of lithium battery supply | Electric vehicle transition |

| Container shipping | Asian carriers | 60% of global capacity | Trade flow control |

| Solar panels | China | 70% of global production | Renewable energy dependence |

8. Global Trade and Regional Trade Blocs Shaping Diplomacy

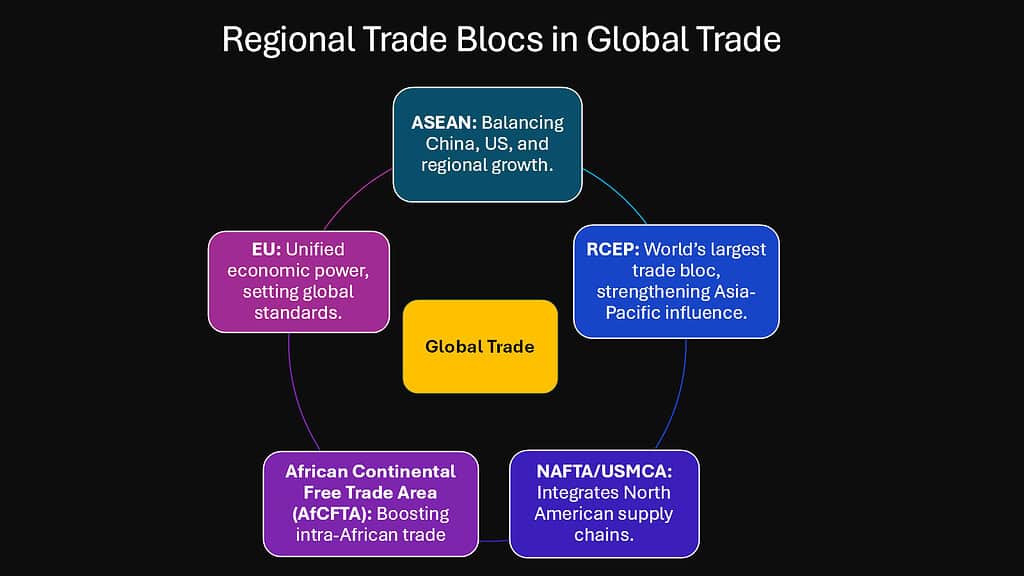

Regional trade agreements have evolved into powerful diplomatic instruments that create new centers of economic gravity and alter traditional alliance patterns. These trading blocs often transcend purely commercial objectives, serving as vehicles for political coordination and collective influence in global affairs.

The European Union represents the most advanced example of trade integration driving political unity. What began as the European Coal and Steel Community has evolved into a comprehensive economic and political union that speaks with a unified voice on trade issues and increasingly coordinates foreign policy positions.

The Regional Comprehensive Economic Partnership (RCEP), led by China and including 15 Asian nations, creates the world’s largest trading bloc by GDP and population. This agreement strengthens Asian economic integration while potentially reducing dependence on Western markets and institutions.

ASEAN has effectively utilized economic integration to sustain its significance amid the competition between the United States and China. By creating an attractive investment environment and maintaining neutrality, ASEAN nations have been able to benefit from both American and Chinese economic relationships while preserving strategic autonomy.

Table 9: Major Regional Trade Blocs and Their Strategic Impact

| Trade Bloc | Member Countries | Combined GDP | Geopolitical Significance |

|---|---|---|---|

| Regional Comprehensive Economic Partnership (RCEP) | 15 Asian nations | $26.2 trillion | China-led Asian integration |

| European Union (EU) | 27 European nations | $18.4 trillion | Western unity, regulatory influence |

| United States-Mexico-Canada Agreement (USMCA) | 3 North American nations | $24.3 trillion | North American integration |

| Association of Southeast Asian Nations (ASEAN) | 10 Southeast Asian nations | $3.6 trillion | Strategic hedging between powers |

| African Continental Free Trade Area (AfCFTA) | 54 African nations | $3.4 trillion | African economic integration |

| Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) | 11 Pacific nations | $13.4 trillion | Asia-Pacific without China |

Conclusion: Global Trade as the Defining Force in Geopolitics

The intricate web of global trade relationships has become the invisible architecture of international relations, more powerful than military alliances and more enduring than diplomatic agreements. As global trade approaches $33 trillion in value, it represents not merely the exchange of goods and services, but the fundamental organizing principle of world politics in the 21st century.

Nations that understand the geopolitical dimensions of trade position themselves to thrive in an interconnected world, while those that ignore these realities find themselves vulnerable to economic coercion and strategic isolation. The COVID-19 pandemic and subsequent supply chain disruptions have awakened governments worldwide to the national security implications of trade relationships, leading to a new era where economic security and military security are increasingly inseparable.

The future will likely see even greater integration between trade policy and foreign policy, as nations seek to build resilient supply chains, secure access to critical resources, and leverage economic relationships for strategic advantage. Understanding global trade patterns has become essential for predicting international conflicts, anticipating alliance shifts, and preparing for the challenges of an increasingly multipolar world.

The eight powerful ways that global trade shapes geopolitics explored in this analysis reveal a world where economic interdependence creates both opportunities for cooperation and tools for competition. As nations navigate this complex landscape, the ability to harness trade relationships while managing their vulnerabilities will determine which countries will rise to global leadership and which will find themselves relegated to the margins of international influence.

Table 10: Future Trends in Global Trade and Geopolitical Implications

| Emerging Trend | Timeline | Geopolitical Impact | Strategic Preparations Required |

|---|---|---|---|

| Supply chain regionalization | 2025-2030 | Reduced globalization, increased bloc formation | Domestic manufacturing investment |

| Green trade standards | 2025-2035 | Environmental diplomacy, carbon border adjustments | Sustainable technology development |

| Digital trade governance | 2024-2028 | Data sovereignty, platform regulation | Digital infrastructure investment |

| Climate-driven trade shifts | 2025-2050 | Arctic routes, resource redistribution | Climate adaptation strategies |

| Space commerce integration | 2030-2040 | New frontiers for competition | Space technology development |

| Artificial intelligence trade | 2025-2035 | AI governance, technological sovereignty | AI capability building |

The evolution of global trade from simple commercial exchange to the primary arena of international competition reflects the fundamental transformation of power in the modern world. Those who master its flow and complexities will shape the future of international relations for generations to come.