Table of Contents

Introduction: Supply Chain – Superpower Behind Global Winners

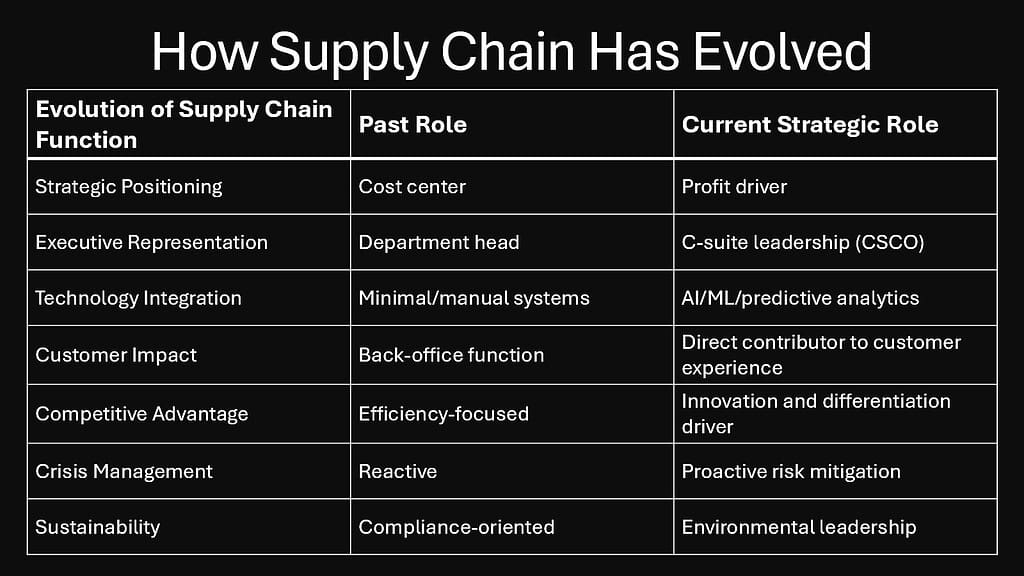

The invisible architecture that powers global commerce has emerged from the shadows. Supply chain—once relegated to the back rooms of corporate strategy—now stands at the forefront of market dominance. In an age where speed, efficiency, and adaptability determine winners, supply chain capabilities have transformed from mere operational necessities into potent competitive weapons.

Consider how Apple outmaneuvered competitors during the global chip shortage, securing priority access to critical components while others faltered. Or how Zara revolutionized fashion retail not through design alone, but through a supply chain capable of moving from concept to store in under two weeks. These aren’t coincidental successes but deliberate strategic advantages forged through supply chain excellence.

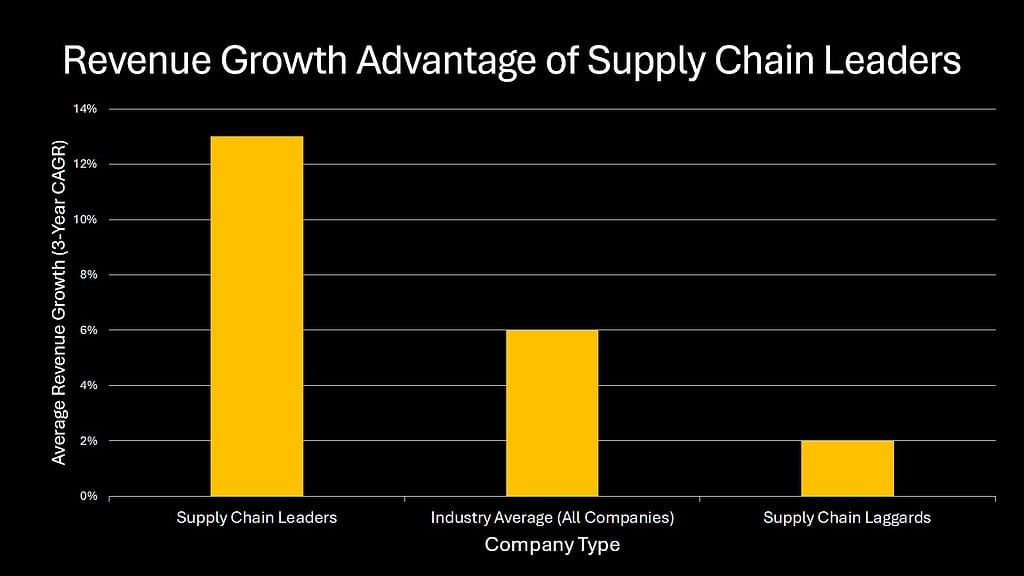

The modern supply chain serves as the vital connective tissue linking every business function. It works in concert with marketing to ensure promotions align with inventory capabilities, collaborates with finance to optimize capital allocation, empowers sales with reliable delivery promises, supports product development with material sourcing expertise, and partners with HR to maintain the human capital needed for logistics execution. This integration explains why companies with superior supply chains consistently outperform competitors by margins that extend far beyond operational efficiency alone.

The evolution has been remarkable. What began as a function focused primarily on cost reduction now drives revenue growth, enhances customer experience, enables sustainability initiatives, and provides critical competitive intelligence. The pandemic merely accelerated a transformation already underway—exposing the fundamental truth that supply chain resilience directly correlates with business survival.

As we explore the six dimensions that make supply chain a true corporate superpower, we’ll see how today’s market leaders have harnessed logistics excellence to not merely participate in global commerce, but to fundamentally reshape it. The competitive battlefield has shifted—those who master supply chain complexity now hold the keys to market domination.

1. Agility in Motion: The Power of Real-Time Response

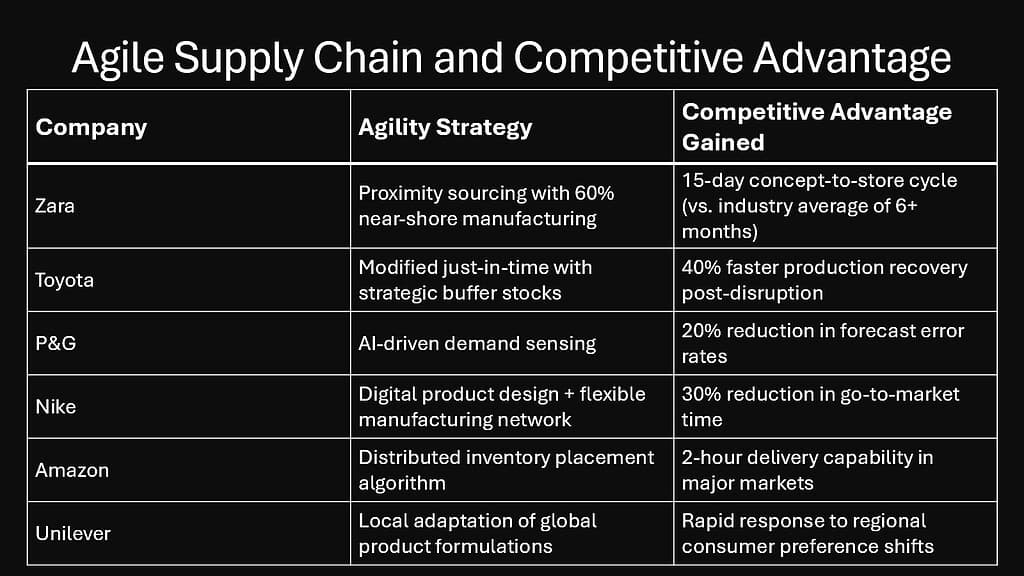

The modern supply chain must perform a delicate balancing act: maintaining efficiency while pivoting rapidly in response to unpredictable market shifts. This capacity for agile adaptation has become perhaps the most valuable dimension of supply chain excellence, enabling companies to capitalize on opportunities while competitors remain paralyzed by change.

Spanish fashion giant Zara exemplifies this principle through its revolutionary approach to fashion retail. While traditional competitors operated on 6-9 month production cycles, Zara engineered a supply chain capable of moving from concept to consumer in just 15 days. This isn’t merely faster production—it represents a fundamental rethinking of how to organize operations for maximum responsiveness. By maintaining approximately 60% of its manufacturing capacity in proximity to its design headquarters and major markets, Zara sacrifices some cost efficiency for unprecedented speed. The result? The ability to rapidly prototype designs, test market response, and scale production only for proven winners.

Similarly, Toyota’s pioneering just-in-time system revolutionized manufacturing by creating a production environment where components arrive precisely when needed rather than sitting as expensive inventory. This approach depends entirely on a supply chain capable of real-time adaptation to production needs. When Toyota recognized the vulnerability of this system during the pandemic, it didn’t abandon the approach—it evolved it by establishing safety stock for critical components while maintaining the agility benefits of the overall system.

The common thread among these leaders isn’t just speed—it’s intelligent speed. They’ve built supply chains capable of gathering and processing real-time data, detecting patterns before they become obvious market trends, and reconfiguring operations in response. This represents a fundamental shift from reactive to anticipatory supply chain management, where systems are designed not just to execute efficiently but to sense and respond autonomously.

Companies mastering this dimension recognize that agility isn’t merely about moving faster—it’s about creating organizational structures and partner ecosystems capable of absorbing change without disruption. This capacity to pivot gracefully has become the defining characteristic separating market leaders from also-rans in virtually every industry.

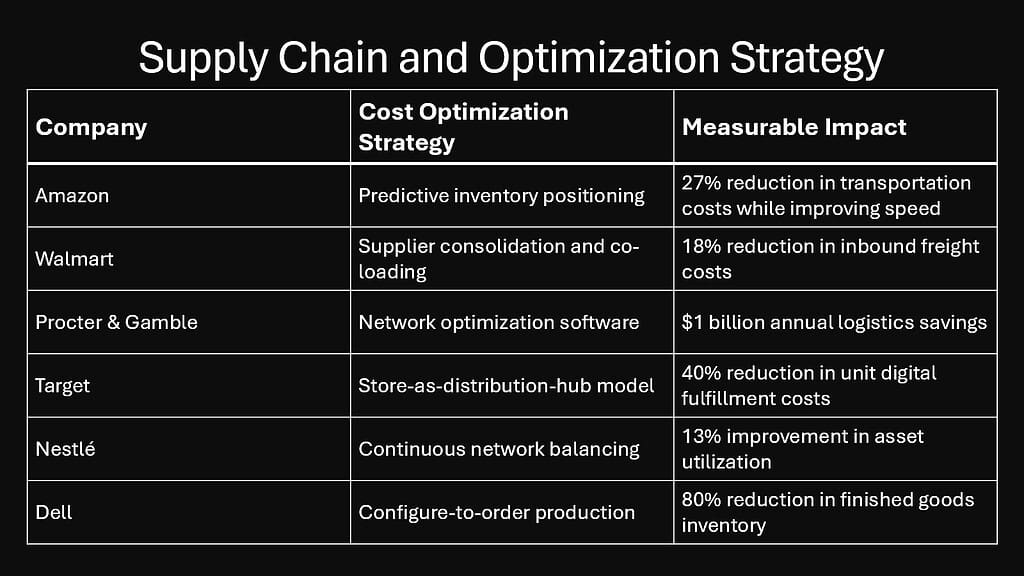

2. Precision at Scale: Optimizing Cost Without Sacrifice

In the realm of supply chain excellence, the true masters have transcended the traditional trade-off between cost and service. While conventional wisdom suggests you can have speed or affordability—but rarely both—companies like Amazon have rewritten the rules through precision operations at massive scale.

Amazon’s fulfillment network represents perhaps the most sophisticated application of precision logistics in commercial history. The company deploys advanced predictive algorithms that anticipate customer purchases before they occur, positioning inventory strategically across its network to minimize both delivery time and transportation cost. This isn’t simply efficient execution—it’s mathematical optimization applied to physical goods movement.

The company’s continuous investment in automation, from its acquisition of Kiva Systems (now Amazon Robotics) to its development of sophisticated sorting technologies, exemplifies how precision can be maintained while handling millions of unique products. When Amazon introduced one-day shipping for Prime members in 2019, competitors struggled to match the offering not because they lacked delivery capacity, but because they lacked the precision logistics to make such service economically viable.

These optimization strategies share a common foundation: they rely on sophisticated data analytics to identify efficiency opportunities that remain invisible to conventional analysis. Target’s transformation of retail stores into fulfillment hubs illustrates this principle perfectly. By leveraging existing assets (stores) to serve a new function (e-commerce fulfillment), the company achieved dramatic cost savings without compromising service levels.

What distinguishes true supply chain leadership in cost optimization is the refusal to accept false choices. When H&M struggled with $4.3 billion in unsold inventory in 2018, it wasn’t just a financial problem but a signal that the company’s supply chain lacked the precision to match production with actual demand. In contrast, companies like Inditex (Zara’s parent) have built systems that produce closer to real-time demand, dramatically reducing both waste and discount-driven margin erosion.

The precision imperative extends beyond large enterprises. Even mid-sized companies have found competitive advantage through similar approaches. Craft brewery New Belgium developed proprietary distribution optimization software that enabled it to expand national distribution while maintaining product freshness—a critical quality factor. This precision approach delivered both cost efficiencies and quality advantages simultaneously.

As global uncertainty increases, the advantage gap between companies with precision supply chains and those without will only widen. The winners will be those who view optimization not as a cost-cutting exercise but as a strategic capability that enables market expansion and customer experience differentiation.

3. Global Reach, Local Speed: Winning with Last-Mile Power

The final stretch of the supply chain—the infamous “last mile” that connects distribution networks to customers—has emerged as perhaps the most critical competitive battleground in modern commerce. Companies that master this complex delivery zone gain not just operational efficiency but profound customer loyalty and market penetration capabilities that extend far beyond logistics.

India’s Flipkart revolutionized e-commerce in the challenging Indian market through its innovative hyperlocal delivery model. Rather than imposing standardized Western fulfillment approaches, Flipkart built a network of over 100,000 local delivery partners, including thousands of small shop owners who serve as pickup points. This model doesn’t just overcome infrastructure challenges—it creates community integration that global giants struggle to match. During the 2021 festive season, this approach enabled Flipkart to reach consumers in over 1,000 Indian cities within 24 hours, establishing market leadership through superior last-mile capabilities.

UPS transformed last-mile economics through its proprietary ORION (On-Road Integrated Optimization and Navigation) system. This sophisticated algorithm optimizes delivery routes across multiple variables, saving the company an estimated 100 million miles of driving annually. The true innovation isn’t just the technology but how UPS integrated driver knowledge with algorithmic efficiency. By incorporating driver insights into route planning rather than imposing purely mathematical solutions, UPS achieved higher adoption rates and better real-world performance.

Supply Chain: Globalization and Localization

| Company | Last-Mile Innovation | Market Impact |

|---|---|---|

| Flipkart | 100,000+ local delivery partner network | Reach into 1,000+ Indian cities with next-day service |

| UPS | ORION route optimization system | $300-400 million annual savings, 20% carbon reduction |

| JD.com | Urban drone and autonomous vehicle delivery | 35-minute delivery in major Chinese cities |

| Deliveroo | Hyperlocal dark kitchens | 30% order growth in underserved markets |

| Amazon | Key by Amazon in-home delivery | 26% reduction in package theft, increased customer trust |

| Mercado Libre | Micro-fulfillment centers in Latin America | 65% improvement in same-day delivery capability |

The most sophisticated last-mile innovations extend beyond pure logistics to create new customer experiences and value propositions. Amazon’s acquisition of Whole Foods wasn’t merely a retail play but a strategic move to position high-frequency inventory closer to urban consumers, enabling both grocery delivery and more efficient general merchandise fulfillment.

Regional variations in last-mile excellence reveal important patterns. In China, JD.com has deployed over 200,000 delivery stations that serve as both pickup points and community hubs. This approach has enabled the company to achieve 90% penetration of lower-tier cities and rural areas that competitors struggle to serve profitably. In Latin America, Mercado Libre’s development of a proprietary last-mile delivery network (Mercado Envíos) transformed the company from a marketplace into a logistics powerhouse, providing delivery reliability in markets previously considered unserviceable.

The economic implications of last-mile excellence extend far beyond operational metrics. Companies with superior last-mile capabilities consistently demonstrate higher customer lifetime value, reduced acquisition costs, and improved margin profiles. This explains why Amazon continues to invest billions in last-mile innovation despite already having industry-leading capabilities—the competitive advantage extends well beyond immediate delivery economics.

As commerce continues its digital transformation, last-mile excellence will increasingly determine which companies thrive and which struggle. The winners will be those who view the last mile not merely as a cost center but as a strategic asset that creates meaningful differentiation in the customer experience.

4. Resilience Reimagined: Turning Crises into Comebacks

The pandemic brutally exposed the difference between theoretical and actual supply chain resilience. While many companies claimed to have robust risk management strategies, only a select few demonstrated genuine resilience when global systems faced unprecedented strain. These rare organizations didn’t just weather the crisis—they emerged stronger, gaining market share while competitors struggled with basic operational continuity.

Unilever stands as a prime example of resilience by design rather than accident. Long before COVID-19, the company had systematically restructured its supply network around regional production hubs rather than centralized manufacturing. This approach—driven initially by sustainability concerns about transportation emissions—created inherent redundancy that proved invaluable during pandemic disruptions. When competitors with Asian-concentrated manufacturing faced complete shutdowns, Unilever maintained approximately 85% operational capacity throughout the crisis, allowing it to meet surge demand for hygiene products while others faced empty shelves.

The semiconductor industry offers another instructive case study in resilience strategies. Taiwan Semiconductor Manufacturing Company (TSMC) maintained production throughout multiple crises through its sophisticated risk mitigation approach. The company maintains strategic inventory of critical materials, operates plants with deliberate geographic dispersion, and employs advanced scenario planning to anticipate disruptions. When water shortages threatened Taiwan’s production in 2021, TSMC had already secured alternative sources and implemented conservation technologies, enabling continuous production while other manufacturers faced shutdowns.

Supply Chain and Crisis Management

| Company | Resilience Strategy | Crisis Performance Outcome |

|---|---|---|

| Unilever | Regional manufacturing hubs | Maintained 85% capacity during pandemic peak disruption |

| TSMC | Strategic material reserves + geographic dispersion | Continued production through Taiwan water crisis |

| 3M | Surge capacity maintenance | Increased N95 mask production by 1200% in 60 days |

| Toyota | Post-Fukushima supplier visibility system | 40% faster recovery from 2021 chip shortages than competitors |

| Nestlé | Climate-adaptive agricultural sourcing | Maintained coffee production despite crop failures |

| Walmart | Pre-positioned emergency response centers | 70% faster disaster zone restocking than industry average |

The pandemic accelerated a fundamental shift in how companies value resilience. Pre-COVID, redundancy was often viewed as inefficient—a costly insurance policy against unlikely events. The new calculus recognizes resilience as a competitive necessity with positive ROI even during normal operations. Companies like Mastercard have formalized this approach through their “principled redundancy” strategy, which identifies critical system components and deliberately creates multichannel capabilities to ensure continuous operation.

The most sophisticated resilience strategies extend beyond internal operations to encompass supplier networks. After experiencing devastating disruption from the 2011 Fukushima disaster, Toyota developed its RESCUE system for supplier visibility, which maps component sources down to tier-three and tier-four suppliers. This comprehensive visibility enabled Toyota to identify potential chip shortage impacts earlier than competitors during the semiconductor crisis, allowing it to secure alternate sources while other automakers faced production shutdowns.

What distinguishes truly resilient organizations isn’t merely preparation for specific threats but the creation of adaptable systems capable of responding to unanticipated challenges. L’Oréal demonstrated this capacity when it rapidly repurposed manufacturing facilities to produce hand sanitizer during pandemic shortages. This wasn’t a planned contingency but rather the result of creating flexible production systems and decision-making structures that enable rapid adaptation.

As climate change, geopolitical tensions, and technological disruptions increase system volatility, resilience will increasingly separate market winners from losers. The strategic advantage will flow to organizations that view resilience not as a defensive cost but as an offensive capability that enables consistent performance in an inconsistent world.

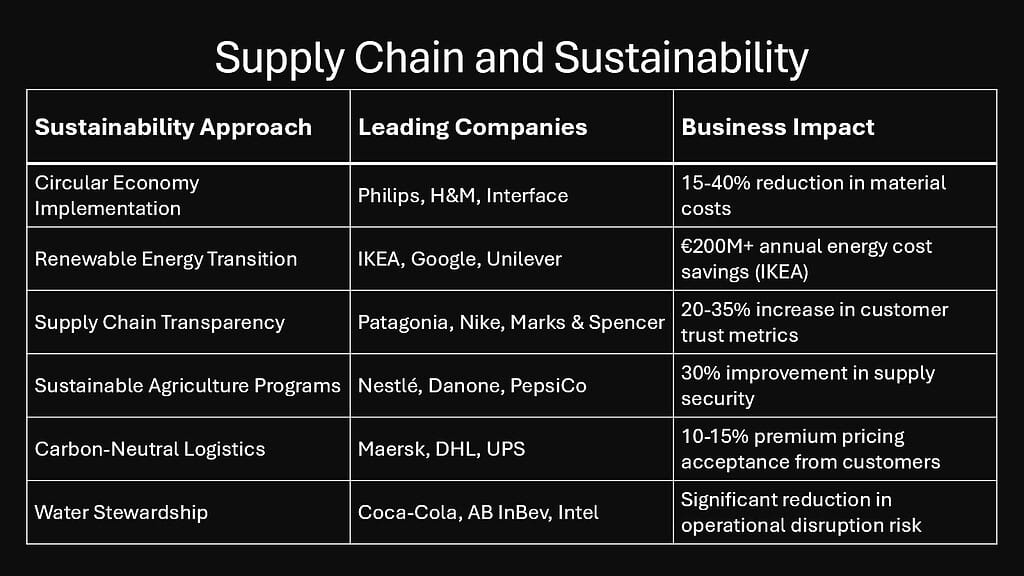

5. Green Advantage: Building Trust Through Sustainability

Sustainability has transformed from a compliance obligation to a central competitive advantage in supply chain strategy. Companies that lead in environmental performance aren’t just satisfying regulatory requirements—they’re capturing premium market positions, reducing operational costs, and building resilience against resource volatility.

IKEA exemplifies how environmental leadership can simultaneously deliver ethical and economic benefits. The company’s commitment to 100% renewable energy across its operations has reduced costs by approximately €200 million annually while strengthening its brand position with environmentally conscious consumers. More impressively, IKEA has engineered its product designs and packaging specifically for supply chain efficiency, reducing transportation volume needs by up to 50% for some product lines. This integrated approach demonstrates how sustainability initiatives, when properly designed, create multiple competitive advantages simultaneously.

Patagonia has perhaps gone furthest in transforming supply chain transparency from a risk to an advantage. Through its Footprint Chronicles initiative, the company provides unprecedented visibility into its material sourcing and manufacturing processes. Rather than hiding potential issues, Patagonia proactively identifies and addresses them, building consumer trust through honesty rather than perfection. This approach has helped the company achieve 25% compound annual growth over the past decade despite premium pricing in a highly competitive market.

The economic case for sustainable supply chains has become increasingly compelling as resource constraints intensify. Nestlé’s investment in direct farmer relationships and agricultural training programs through its Nescafé Plan wasn’t driven primarily by altruism but by the strategic need to secure coffee supplies in the face of climate change impacts. By helping over 100,000 farmers adopt more sustainable practices, Nestlé has both improved its environmental footprint and protected its supply base from climate-related disruptions.

The transition to sustainable supply chains involves complex trade-offs that require sophisticated management. When Walmart committed to removing 1 billion metric tons of emissions from its supply chain by 2030 through Project Gigaton, it faced the challenge of maintaining its low-price value proposition while pushing suppliers toward sustainable practices. The company’s solution was to provide suppliers with technical assistance and financing options that made sustainability economically viable, demonstrating how market leaders can drive system-wide improvement.

Innovation in sustainable logistics continues to accelerate. Maersk’s investment in carbon-neutral vessels powered by methanol represents a bold bet on the future of shipping. While these ships require approximately 10-15% higher capital investment than conventional vessels, they position Maersk to meet the growing demand from companies like Amazon, Unilever, and Microsoft that have committed to dramatic carbon reduction across their supply chains. The willingness of these customers to pay premium rates for carbon-neutral shipping transforms sustainability from a cost center to a revenue driver.

As environmental regulations tighten globally and consumer preferences continue shifting toward sustainable products, supply chain sustainability will increasingly determine market winners and losers. The advantage will flow to organizations that move beyond compliance to leadership, finding innovative ways to make environmental responsibility a source of competitive differentiation rather than merely a cost of doing business.

6. Data-Led Dominance: Insights That Drive Strategy

The transformation of supply chains from physical operations to information-powered networks represents perhaps the most fundamental shift in logistics strategy over the past decade. Companies that have mastered the collection, analysis, and application of supply chain data have gained advantages that extend far beyond operational efficiency into strategic market positioning.

Walmart pioneered this approach with its legendary data capabilities. The retailer’s investment in advanced inventory management technology enables it to track over 200 million SKUs across more than 10,500 stores globally with near-perfect accuracy. This visibility allows Walmart to reduce carrying costs by billions annually while maintaining higher in-stock availability than competitors. The company’s early adoption of RFID technology for apparel tracking—which reduced out-of-stocks by 30%—demonstrates how data investments directly translate into customer experience and sales advantages.

DHL’s application of artificial intelligence to route planning illustrates how data can transform established processes. The company’s AI-powered SmarTrucking system analyzes over 50 variables—from traffic patterns to weather conditions—to optimize delivery routes dynamically. This approach has reduced delivery times by up to 25% while lowering fuel consumption and environmental impact. What makes this capability strategically valuable isn’t just the immediate operational benefits but the cumulative learning advantage as DHL’s algorithms improve through continuous data acquisition.

The most sophisticated practitioners have moved beyond using data for operational decisions to employing it for strategic market positioning. Flexport revolutionized freight forwarding by building its entire business model around data transparency. By providing shippers with unprecedented visibility into their global supply chains, Flexport has grown from startup to $8 billion valuation in less than a decade, demonstrating how information itself can become a primary value proposition in logistics.

The competitive implications of data mastery extend beyond direct cost and service improvements to strategic adaptability. Companies with sophisticated data capabilities detected early pandemic demand shifts weeks before competitors, allowing them to reposition inventory and secure capacity while others remained reactive. This information advantage translated directly into market share gains during periods of constrained supply.

The convergence of physical and digital supply chains has created new competitive battlegrounds. Traditional logistics providers now compete with technology companies like Project44 and FourKites that specialize in supply chain visibility. These platforms have captured significant enterprise value by positioning themselves as essential data intermediaries rather than asset operators, signaling how information itself has become a primary source of value in modern supply networks.

Looking forward, machine learning applications represent the next frontier in supply chain data utilization. Manufacturers like Siemens are developing “digital twin” simulations of their entire supply networks, allowing them to test scenarios and optimize decisions before implementation. This capability dramatically accelerates learning cycles and reduces the risk of operational changes.

The strategic imperative is clear: companies that develop superior capabilities to collect, analyze, and act upon supply chain data will increasingly outperform their peers across all operational dimensions. The advantage gap between data leaders and followers will likely widen as algorithms become more sophisticated and data sets more comprehensive, making this capability perhaps the most critical investment priority for supply chain leaders.

Conclusion: From Back-End to Battlefield—Supply Chain Wins

The transformation of the supply chain from a support function to a strategic arm represents one of the most significant shifts in modern business strategy. Throughout this exploration, we’ve seen how logistics excellence has enabled market leaders to outmaneuver competitors in ways that extend far beyond operational efficiency to fundamental market advantage.

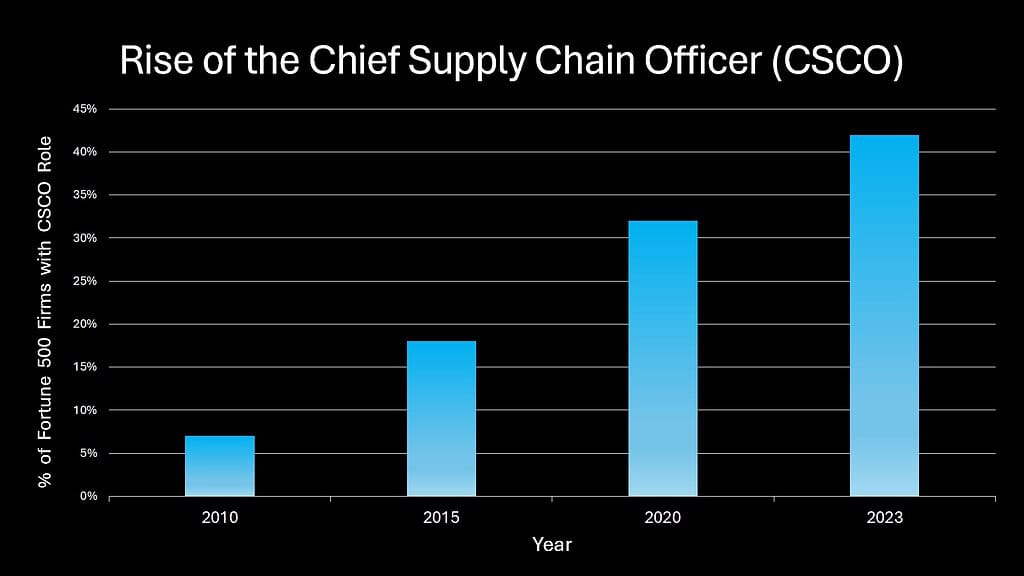

The six dimensions we’ve examined—agility, precision at scale, last-mile excellence, resilience, sustainability, and data-led insight—combine to form a formidable competitive arsenal. Companies that master these capabilities don’t just execute more efficiently; they compete differently, often rewriting industry rules in the process.

This strategic elevation explains why supply chain leadership has moved into the C-suite, with Chief Supply Chain Officers now standard in Fortune 500 companies. It explains why private equity firms increasingly conduct supply chain capability assessments before acquisitions, recognizing that logistics strength often determines which companies can scale profitably. And it explains why organizations like Amazon, which began as retail businesses, have transformed into logistics powerhouses that leverage supply chain mastery to enter and disrupt adjacent industries.

Looking ahead, supply chain mastery will likely become even more determinative of market success. As physical and digital convergence accelerates, as sustainability imperatives reshape resource flows, and as geopolitical complexity increases, the advantage will flow to organizations with supply networks capable of navigating this uncertainty with confidence.

The strategic implication is profound: in an era defined by volatility, the most valuable corporate capability may be the ability to move physical goods with digital precision and adaptive intelligence. The quiet power behind the scenes—the supply chain—has emerged as the battlefield where market dominance is increasingly determined.

For business leaders, the mandate is clear. Supply chain cannot remain an operational afterthought but must be elevated to a core strategic consideration. The organizations that recognize this shift and invest accordingly will find themselves with a superpower their competitors cannot easily match—a supply chain that doesn’t just support strategy but defines it.